Why It Matters

Financial planning in Canada offers an impressive range of programs from retirement accounts to homebuyer incentives and government-supported savings tools. The challenge is not just knowing these tools exist but understanding how they fit together to bring your goals closer.

For some families, this means building long-term security for a loved one with a disability. For others, it is finding the fastest path into the housing market or ensuring retirement savings grow in the most tax-efficient way.

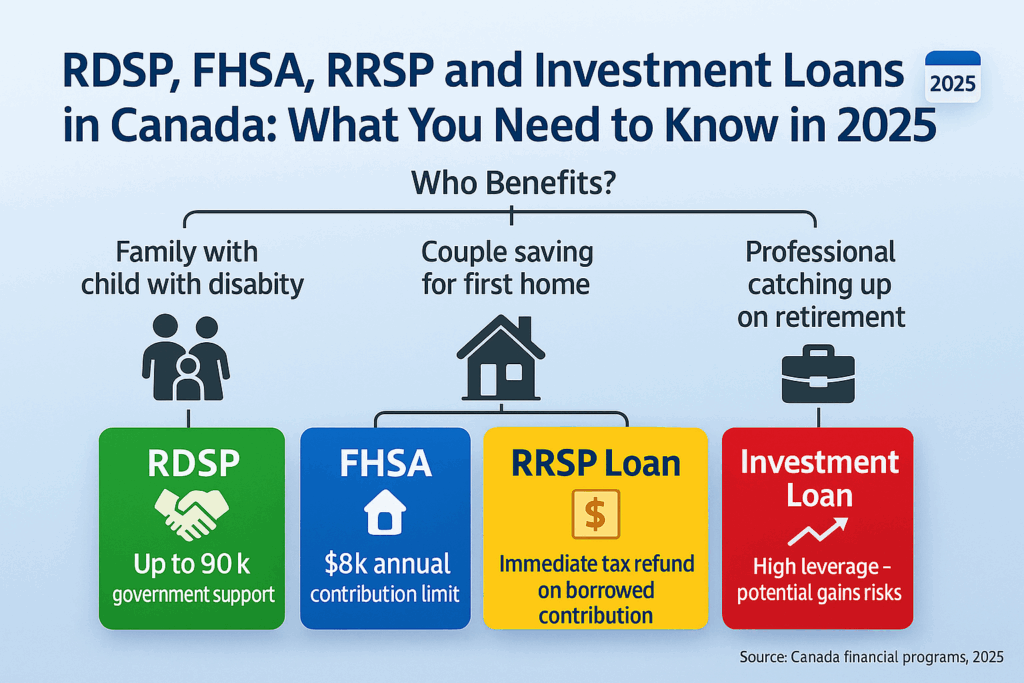

In 2025, four instruments deserve particular attention:

- RDSP (Registered Disability Savings Plan) — grant-driven support for families/individuals eligible for the Disability Tax Credit (DTC).

- FHSA (First Home Savings Account) — a bridge into the housing market with deduction now (or later) and tax-free withdrawal for a first home.

- Investment Loans — a tax-planning tool for higher, stable incomes to scale a non-registered portfolio.

- RRSP Loans — a way to pull forward RRSP contributions and refunds.

Each one has its own rules, benefits, and risks. Used wisely, they can change a financial trajectory for decades.

RDSP (Registered Disability Savings Plan)

More Than a Savings Account

The RDSP is a uniquely powerful program for Canadians living with disabilities and their families. Life with a disability often comes with hidden costs, specialized care, equipment, and daily barriers. The RDSP is designed to ease that burden, offering government contributions that can far exceed what the individual puts in.

How It Works

- Beneficiaries must qualify for the Disability Tax Credit (DTC).

- Contributions are not tax deductible, but investment growth is tax sheltered until withdrawal.

- Federal grants can match contributions up to $3,500 annually.

- Canada Disability Savings Bonds add up to $1,000 per year, even without personal contributions.

- Over a lifetime, government support can reach $90,000.

- Retroactive catch-up is possible once the account is open (subject to annual limits).

- A 10-year assistance holdback applies—plan withdrawals carefully.

Why It Matters

A modest annual contribution combined with government top-ups can turn into substantial long-term savings. For a family supporting a child with a disability, this means peace of mind that resources will be available well into adulthood.

Example: Contributing $1,500 annually from childhood could, with grants and compound growth, grow to more than $1 million by age 60.

Best For

- Families caring for children with disabilities

- Adults with disabilities planning long-term independence

- Households seeking both security and tax-efficient growth

Key message: If there’s even a chance of eligibility, open the RDSP so you don’t leave money on the table.

FHSA (First Home Savings Account)

A Bridge Into the Housing Market

Housing affordability continues to be one of Canada’s toughest challenges. Saving for a down payment can take years. The FHSA, introduced recently, blends the benefits of the RRSP and TFSA into a single program to help first-time buyers get there faster.

How It Works

- Annual contribution limit: $8,000

- Lifetime contribution cap: $40,000

- Contributions lower taxable income, generating refunds like an RRSP.

- Withdrawals for a home purchase are tax free, like a TFSA.

- If a home isn’t purchased, funds can roll into an RRSP or RRIF penalty free.

Why It Matters

The FHSA is more than just another account. It gives young professionals and families a tangible way to close the gap on housing affordability.

Example: A couple in their early thirties contributing $8,000 annually for five years reaches $40,000. With growth and tax refunds, their effective down payment could exceed $50,000 potentially shaving years off the wait to buy a first home.

Best For

- First-time buyers under pressure from rising housing costs

- Young professionals looking to maximize tax deductions while saving

- Families helping adult children enter the housing market

Investment Loans

Using Leverage With Caution

An investment loan is simple in concept: borrow to invest and let more capital work for you. The potential upside is higher returns. The risk is magnified losses.

How It Works

- Funds are borrowed from a bank or financial institution.

- Borrowed money is invested in eligible assets such as segregated funds.

- Loan interest is tax deductible.

Advantages

- Scale your portfolio from day one.

- When borrowing is used to earn investment income in a non-registered account, interest is always deductible.

- Only 50% of capital gains are taxable; you can often offset that taxable half with an RRSP contribution (if you have room).

How to use it well

- Borrowed funds go to a non-registered account; that account is typically pledged as collateral.

- Do an annual February check-in: review gains, then decide how much to lock in and how much to contribute to RRSP before the deadline to fine-tune that year’s tax.

Balance in one line: Leverage magnifies both gains and losses—stress-test cash flow first. For the right profile, the growth + tax effects can outweigh the risks.

Example: Borrowing $100,000 at 10-12% expected return could generate strong long-term growth. But if markets decline early, the investor is left with debt and weaker assets.

Best For

- Higher-income clients with stable cash flow, a long horizon, and the discipline to manage leverage through market cycles.

- Clients with a diversified financial plan and cash reserves

RRSP Loans

Boosting Retirement Savings Today

RRSP loans are a form of investment loan aimed specifically at maximizing retirement savings. Instead of delaying contributions until you have the cash, you borrow to fill your contribution room now and reap immediate tax benefits.

How It Works

- The loan is taken solely for an RRSP contribution

- Apply the resulting tax refund immediately to the loan balance or check other available options.

- Contributions start compounding tax deferred immediately.

- Credit reporting varies: some programs don’t appear up to 2 years; others are appearing like a standard installment loan. Terms can range 1–10 years.

- On-time payments help; missed payments hurt—like any credit product.

Why It Matters

Even one or two extra years of full RRSP contributions can dramatically increase retirement savings. The tax refund offsets costs and accelerates growth.

Start tax-deferred compounding today and use the tax refund to quickly reduce the loan.

Example: A professional with $10,000 unused RRSP room takes a short-term loan. The tax refund reduces the loan balance, while the earlier investment compounds over decades, producing tens of thousands more by retirement.

Best For

- High-income earners seeking immediate tax relief

- Individuals catching up on unused RRSP room

- Disciplined savers who can repay loans comfortably

Common Misconceptions

- RDSP requires big contributions: In fact, low-income households can benefit through the Canada Disability Savings Bond even without deposits.

- FHSA is only for singles: Couples can each open one, doubling the down payment potential.

- Investment loans are a shortcut to wealth: Tax-effective products for high-income individuals and for retirement planning.

- RRSP loans are risky for everyone: With stable income and proper planning, they can be one of the most effective retirement tools.

Comparison at a Glance

| Tool | Annual Limit | Lifetime Limit | Tax Benefit | Best For | Risk Level |

| RDSP | No strict limit (grant max $3,500) | $90,000 in grants/bonds | Growth tax-sheltered | Families with disabilities | Low |

| FHSA | $8,000 | $40,000 | Tax deduction + tax-free withdrawal | First-time buyers | Low |

| Investment Loan | Based on credit | N/A | Loan interest is deductible | Aggressive investors | High |

| RRSP Loan | Based on income/room | N/A | Immediate tax refund + compounding | Savers with unused RRSP room | Medium |

How to Combine These Tools

- FHSA + RRSP: Save for a home while building retirement savings with tax deductions on both.

- RDSP + TFSA: Maximize security for a loved one with disability while keeping flexible savings.

- RRSP Loan + Investment Portfolio: Boost retirement growth while maintaining diversification.

Frequently Asked Questions (FAQ)

Can I have both an FHSA and an RRSP?

Yes. In fact, many Canadians use both. The FHSA provides tax deductions and tax-free withdrawals for a first home purchase, while the RRSP builds retirement wealth with tax deferral. If you don’t end up buying a home, your FHSA balance can be transferred to your RRSP without penalty, so the two accounts complement each other.

Do RDSP withdrawals affect disability benefits?

In most provinces, RDSP withdrawals do not reduce eligibility for federal programs such as the Old Age Security (OAS) or the Guaranteed Income Supplement (GIS). Some provincial disability assistance programs also exempt RDSP assets and withdrawals. Always confirm with your provincial regulations, but generally the RDSP is designed to protect not jeopardize other supports.

What happens if I can’t repay an RRSP loan quickly?

Most financial institutions offer flexible repayment terms, often ranging from a few months to a few years. However, interest continues to accrue, which can erode the benefit if repayment takes too long. A common strategy is to use the tax refund generated by the RRSP contribution to immediately pay down part of the loan, reducing the balance and interest cost.

Are investment loans suitable for new investors?

Usually not. Leveraged investing is best suited for individuals with stable income, strong risk tolerance, and a long-term horizon. For new investors, the emotional stress of market swings combined with loan obligations can lead to poor decision-making. It’s better to start with TFSA or RRSP contributions and build experience before considering leverage.

Can my spouse also open an FHSA?

Yes. Each eligible individual can open their own FHSA. For couples, this effectively doubles the contribution room, giving a combined lifetime limit of up to $80,000, plus potential growth and tax refunds.

What is the maximum government support I can get from an RDSP?

Through the Canada Disability Savings Grant and Bond, eligible beneficiaries can receive up to $90,000 in government contributions over their lifetime. This includes grants of up to $3,500 annually and bonds of up to $1,000 annually for low-income households.

What if I don’t end up buying a home after using an FHSA?

Your FHSA savings can be transferred into an RRSP or RRIF with no tax penalty. This makes the account “risk-free” in the sense that your savings will still benefit your long-term retirement plan even if your housing plans change.

Do RRSP loans affect my credit score?

Yes, but some RRSP loans don’t appear on your credit file. If managed well and repaid on schedule, it can help build credit history. Missed or late payments, however, will negatively impact your score.

Are there deadlines I should know about?

- FHSA contributions must be made within the calendar year to count.

- RRSP contributions have a deadline 60 days after year-end for tax purposes.

- RDSP contributions can be made up to December 31 of the year the beneficiary turns 59.

Missing deadlines may mean missing out on grants, bonds, or tax deductions.

Can family or friends contribute to an RDSP or FHSA?

- For RDSP: Yes. Anyone can contribute with the written permission of the plan holder. Government grants will still apply, provided the beneficiary is eligible.

- For FHSA: Only the account holder can contribute, but family members can give money to fund the contributions.

What happens to my RDSP if I lose eligibility for the Disability Tax Credit (DTC)?

Since 2021, RDSP accounts no longer need to be closed if the beneficiary temporarily loses DTC status. Contributions and grants may pause, but existing savings can remain in the account and continue to grow.

Conclusion: Choose the Right Tools, Build Your Future

RDSP, FHSA, investment loans, and RRSP loans open different doors from protecting a loved one’s future to buying a first home or building retirement savings. The right strategy depends on your income, goals, and comfort with risk. What makes the difference is not one product, but a plan that fits your life.

At Boris Kolodner Financial Services, I help clients across Canada cut through the complexity and put these tools to work with clarity and confidence.

📞 Call: 514-834-5558

📧 Email: contact@bkfinancialservices.ca

💻 Schedule a free online consultation today

With the right guidance, you can move from uncertainty to confidence and take control of your financial future.