Most people focus on their gross salary but make financial decisions based on net income. The difference between these figures is shaped by Quebec’s unique tax and social contribution structure. Provincial rates are notably high. Yet, Quebec offers its own credits, parental insurance, and pension rules, all significantly influencing take-home pay.

Understanding each deduction allows you to estimate your net income more accurately, adjust your contributions, and avoid unpleasant surprises at tax time.

This guide explains Quebec paycheque calculations. It covers how federal and provincial tax brackets combine, mandatory social contributions, and how tools like RRSP contributions or employer benefits affect your final net amount.

Step 1: Beginning with Your Gross Income

Your employment contract lists your gross annual salary. Payroll formulas then translate it into a per-paycheque amount depending on how often you’re paid: weekly, bi-weekly, semi-monthly, or monthly.

Example:

- Salary: 70,000 CAD per year

- Bi-weekly: approximately 2,692 CAD

- Monthly: approximately 5,833 CAD

These numbers are only the starting point. All deductions are calculated from this gross amount before you receive your net pay.

Step 2: Federal and Quebec Tax Brackets – Understanding Their Interaction

Quebec workers pay both federal and provincial income tax. Each system applies its own progressive brackets to the same income.

Federal brackets move through several rates as income increases. Quebec’s brackets do the same but at different thresholds and with slightly higher starting rates.

The key principles:

• Your first dollars of income are taxed at the lowest rate at both levels.

• Only the portion of your income above each threshold is taxed at the higher rate.

• Being “in a higher bracket” affects only the marginal slice of income, not your whole salary.

This structure is designed so that increases in salary raise your overall tax gradually, not all at once.

2026 Federal & Quebec Tax Brackets

| Taxable income (2026) | Federal rate | Quebec rate | Approx. combined marginal rate* |

| $0 – $54,345 | 14% | 14% | ~25.69% |

| Over $54,345 – $58,523 | 14% | 19% | ~30.69% |

| Over $58,523 – $108,680 | 20.5% | 19% | ~36.12% |

| Over $108,680 – $117,045 | 20.5% | 24% | ~41.12% |

| Over $117,045 – $132,245 | 26% | 24% | ~45.71% |

| Over $132,245 – $181,440 | 26% | 25.75% | ~47.46% |

| Over $181,440 – $258,482 | 29% | 25.75% | ~50.21% |

| Over $258,482 | 33% | 25.75% | ~53.31% |

*Combined rate net of the 16.5% Quebec abatement on federal tax.

These combined 2026 brackets are based on the latest official tables from the Canada Revenue Agency (CRA) and Revenu Québec.

Step 3: Mandatory Social Contributions (QPP, EI, and QPIP)

Beyond income tax, Quebec employees contribute to three major programs:

• Quebec Pension Plan (QPP)

A pension contribution applied to earnings above a basic exemption and up to a yearly maximum. This funds your future retirement, disability, and survivor benefits.

• Employment Insurance (EI)

A federal program that provides temporary income during periods of unemployment. Quebec employees pay a slightly lower EI rate because parental benefits are handled separately by QPIP.

• Quebec Parental Insurance Plan (QPIP)

A provincial program that covers maternity, paternity, parental, and adoption benefits. QPIP replaces EI parental benefits in Quebec.

All three contributions stop once you reach the annual maximum for the year. When that happens, your net income increases even though your gross income stays the same.

The exact QPP, EI and QPIP rates and yearly maximums are updated annually by the

Canada Revenue Agency (for EI), Revenu Québec (for QPP) and the

Québec Parental Insurance Plan (QPIP). In this guide, we use the current 2026 limits, but always refer to the official sites for the most recent numbers.

Step 4: How RRSP Contributions Reduce Your Taxable Income

RRSP contributions reduce your taxable income at both federal and provincial levels. This makes them one of the strongest tools for increasing your net pay.

Example:

- Gross income: 70,000 CAD

- RRSP contribution: 7,000 CAD

- Taxable income becomes: 63,000 CAD

At a ~48% combined marginal rate (typical for higher incomes around $130–$180k), a $7,000 RRSP contribution can reduce tax by roughly $3,360.

At a 70k income, combined marginal rates are closer to ~36%, so the same $7,000 contribution would save roughly $2,500 in tax.

Your gross salary stays the same, but payroll withholds less income tax because the system recognizes that you’re deducting part of your income through RRSP contributions. This happens automatically with Group RRSPs (or if you file a form to reduce source deductions for personal contributions).

This effect is especially noticeable in Quebec, where even modest RRSP deposits can meaningfully change your tax withholding.

For homebuyers, contributions to the First Home Savings Account (FHSA) have a similar deduction effect and can be combined with your RRSP Home Buyers’ Plan strategy for a larger down payment.

Step 5: Employer Benefits and Their Taxable Impact

Employer benefits can reduce, increase, or change your taxable income. Quebec classifies many common perks as taxable benefits. This means their value is added to your income before tax calculation.

Typical taxable benefits include:

• Employer-paid health and dental insurance premiums (Specific to Quebec taxation)

• Employer-paid parking

• Personal use of a company car

• Employer contributions to a group RRSP

• Housing and cost-of-living allowances

These benefits raise your taxable income and therefore increase the tax withheld from your pay.

Common non-taxable or not directly taxable benefits include:

• Employer contributions to QPP and EI

• Employer portion of QPIP

• Many types of employer-funded professional training

Understanding whether a benefit is taxable helps explain why your taxable income may be higher or lower than expected.

Step 6: Calculating Your Final Net Pay

Net pay is what remains after all mandatory deductions and contributions are taken from your gross amount.

Your gross pay is reduced by:

• Federal income tax

• Quebec provincial income tax

• QPP contributions

• EI premiums

• QPIP premiums

• RRSP or pension contributions taken at source

• Insurance premiums (if applicable)

• Union dues or professional dues

• Adjustments for taxable benefits

Your employer sends these amounts to the appropriate government bodies. You receive the remainder as your net income.

Understanding each line makes it easier to evaluate job offers, plan savings, and predict cash flow throughout the year.

In my practice, I model your exact 2026 net pay using professional tax and payroll software, not generic online calculators, so you see a realistic number for your situation.

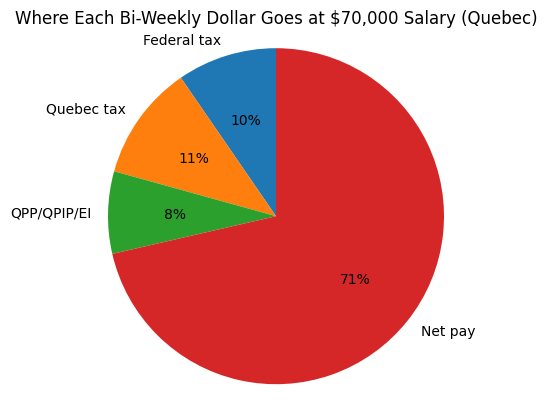

Example: A Typical Quebec Paycheque at $70,000 CAD Annual Salary in 2026 – how much is left on your paycheque?

Consider a simplified scenario:

- Salary: 70,000 CAD

- Pay frequency: bi-weekly

- No RRSP contributions

- Basic personal tax credits only

Typical outcome:

Bi-weekly gross pay: around 2,692 CAD

After federal and Quebec tax, QPP, EI, and QPIP: bi-weekly net pay of roughly 1,800–1,950 CAD, depending on benefits and deductions.

The exact amount varies depending on benefits, credits, and registered plan contributions, but this range reflects a realistic Quebec paycheque at this income level.

During a consultation, I plug your real pay details into professional tax software to show you, line by line, how your own numbers compare to this example.

—

Common Misconceptions About Quebec Paycheques

• “If I move into a higher tax bracket, my entire income is taxed more.”

Only the income above the bracket threshold is taxed at the higher rate.

• “What my employer withholds is my final tax.”

Withholding is only an estimate. Your final tax depends on credits, deductions, RRSP contributions, childcare costs, and other factors.

• “My employer decides my tax amount.”

Employers must follow government payroll formulas. They do not set your tax rate.

• “More benefits automatically increase my net pay.”

If the benefit is taxable, it can reduce your net pay even if it is valuable.

5 Quebec Paycheque Pitfalls in 2026

- Missing the Quebec abatement effect – your real combined marginal rate is federal × (1 – 16.5%) + Quebec, not a simple sum of nominal rates. Planning RRSP/FHSA contributions without this can over/underestimate tax savings.

- Overlooking the new QPP second tier – in 2026, an extra 4% applies on earnings between $74,600 and $85,000, adding up to ~$416 in additional contributions.

- Not revisiting QPP contributions after 65 – if you’re already receiving QPP, you can adjust how long you keep contributing and how that interacts with your pension.

- Taxable health premiums inflating income.

- No source deduction form – over-withheld taxes, delayed refunds (Form TP-1016, T1213, etc).

—

Table: How a Quebec Paycheque Is Structured (2026)

| Component | What It Is | Impact on Net Pay | 2026 Rate/Limit | Example / Note |

| Gross Income | Annual salary before deductions | Starting point for all calculations | – | 70,000 CAD/year ≈ 2,692 CAD bi-weekly |

| Federal Income Tax | Progressive federal tax applied to the same income base | Reduces net pay | 14.5-33%; 2026 brackets up to $258,482, first threshold at $58,523. | Withheld every pay cycle |

| Quebec Income Tax | Provincial tax with its own brackets | Reduces net pay alongside federal tax | 14-25.75%;2026 brackets to $132,245 at 24%, then 25.75% above. | Quebec rates start higher than most provinces |

| QPP | Quebec Pension Plan contribution | Reduces net pay until yearly maximum is reached | 6.30% on earnings between $3,500 and $74,600 (max $4,479.30) + 4% on earnings between $74,600 and $85,000 (additional max $416); total max employee contribution ≈ $4,895 in 2026. | Net pay increases once the cap is hit |

| EI | Employment Insurance premium | Reduces net pay; stops at annual maximum | 1.30% on insurable earnings up to $68,900; max $895.70 (2026 Quebec rate). | Quebec uses a lower EI rate due to QPIP |

| QPIP | Quebec Parental Insurance Plan | Reduces net pay; stops at annual maximum | 0.430% on insurable earnings up to $103,000; max $442.90 (2026). | Replaces EI parental benefits in Quebec |

| RRSP Contributions | Tax-deductible retirement savings | Lowers taxable income → increases net pay | up to 18% of previous year’s earned income, max $33,810 for 2026, subject to PA/PSPA. | 7,000 CAD RRSP reduces taxable income from 70k to 63k |

| FHSA Contributions | First Home Savings Account | Works like an RRSP for first-home buyers | Annual limit $8,000; lifetime limit $40,000; max $8,000 carryover of unused space. | Contributions reduce taxable income. Not to be confused with the TFSA: 7,000 CAD annual limit; cumulative room 109,000 CAD in 2026 for someone eligible since 2009. |

| Taxable Benefits | Employer perks added to taxable income | Reduce net pay because taxes increase | Varies (e.g., health premiums) | Health benefits, parking, company car |

| Non-Taxable Benefits | Employer perks not added to taxable income | No direct reduction in net pay | Training, employer share of QPP/EI/QPIP | |

| Other Deductions | Insurance premiums, union/professional dues | Reduce net pay depending on plan | Varies by employer | |

| Final Net Pay | Amount after all deductions | Actual take-home income | Typically ~1,900–2,000 CAD bi-weekly at 70k salary |

*Rate as of December 2025 for the 2026 tax year.

FAQ

Q: How can I estimate my net pay from my gross salary in Quebec?

A: Start from your gross pay per period, then subtract estimated federal and Quebec income tax, QPP, EI, QPIP, and any pension, RRSP, insurance, and union or professional dues. Online calculators can give a rough idea, but during our meetings I use professional tax and payroll software to model your paycheque precisely with your real benefits, credits and contributions. If you’ve ever wondered how much is left after tax, this is exactly the type of analysis we walk through together, using your own numbers.

Q: Do RRSP and FHSA contributions really increase my take-home pay?

A: They don’t change your gross salary, but they reduce your taxable income. That means less tax is withheld at source, so your net pay can go up while you’re also building savings for retirement or a first home.

Q: Why does my friend with a similar salary have a different net pay?

A: Differences usually come from varying benefits, taxable perks, RRSP or pension contributions, union dues, and personal tax credits. Two people with the same gross income can have very different net pay depending on these factors.

Q: What happens to my pay once I hit the annual QPP, EI, or QPIP maximums?

A: Once you reach the yearly cap for any of these programs, your employer stops withholding that specific contribution. Your gross salary stays the same, but your net pay increases because there is one less deduction.

Q: Can better tax planning really change my monthly cash flow?

A: Yes. Adjusting RRSP/FHSA contributions, understanding taxable benefits, and properly claiming credits can change how much tax is withheld throughout the year and improve your overall after-tax position.

Q: What is Quebec’s top marginal tax rate in 2026?

A: Quebec’s top combined marginal tax rate as of December 2025 is 53.31% (federal 29% + provincial 25.75% after abatement). Plan RRSP contributions strategically to drop into a lower bracket and reduce your effective rate. Quebec’s top combined marginal tax rate on regular income in 2026 is 53.31%, on taxable income over $258,482.

Q: What are the QPP changes for 2026?

A: For 2026, QPP’s YMPE rises to $74,600 and the first-tier employee contribution rate decreases to 6.30%, with a maximum first-tier contribution of $4,479.30. There is also a second tier at 4% on earnings between $74,600 and $85,000, with an additional maximum contribution of $416.

Q: How does QPIP work for self-employed individuals in 2026?

A: Self-employed Quebec residents pay QPIP premiums at twice the employee rate. In 2026, this is 0.860% on eligible earnings up to $103,000, and the premium is generally deductible as a business expense.

Ready to Understand Your Paycheque Clearly?

For a detailed paycheque review and clarity on how tax planning can boost your take-home income, schedule a free consultation.

During the meeting, we’ll go through your salary structure, deductions and credits, RRSP and FHSA opportunities, and outline practical steps tailored to your financial goals.

Book your free consultation today and get a precise, personalized breakdown of your paycheque and tax strategy.

Phone: (514) 834-5558

Email: contact@bkfinancialservices.ca

Languages: English, French, Russian, Hebrew

—

Disclaimer: This guide is for general information only and does not replace personalized tax advice. Tax laws and rates change; always verify current figures or speak with a professional.