Insurance in Quebec does more than cover medical or income costs. It stabilizes your financial plan against unexpected life changes. Major illness, long-term disability, or sudden income loss can disrupt savings and derail goals. The right coverage transforms these events into manageable situations, preventing financial crises.

Quebec combines public programs (RAMQ, QPP, QPIP) with private and employer-sponsored insurance. Many residents are unsure about existing coverage and potential gaps. This guide explains how life insurance, disability insurance, critical illness coverage, and health and dental insurance work together.

Life Insurance in Quebec: Securing Your Family’s Future

Life insurance provides a tax-free lump sum to beneficiaries upon your passing. This benefit can replace income, cover a mortgage, clear debts, or protect long-term family plans.

Term Life Insurance

The most accessible and affordable type of life insurance.

How it works:

You choose the coverage amount and duration (10, 20 or 30 years). Premiums stay level during the term.

Best for:

• a mortgage. Crucial for protecting your Quebec Mortgage strategy.

• dependent children

• income replacement needs

• predictable, affordable protection

At the end of the term, you can renew (at a higher cost), convert to permanent coverage or let it expire.

Permanent Life Insurance

Coverage that lasts for life and may include a cash value component.

Best for:

• lifelong protection

• estate planning and inheritance

• tax-advantaged long-term savings inside the policy

Many families combine both types to balance affordability and stability.

Disability Insurance: Essential Income Protection in Quebec

Disability insurance replaces a portion of your income if illness or injury prevents you from working. This coverage is crucial in Quebec, as QPP disability and CNESST only cover specific situations and rarely provide adequate income replacement.

A typical policy replaces 60–70 percent of your earnings. It pays monthly benefits until recovery or the end of the benefit period.

Group vs Individual Coverage

Employer group plans are common, but they often:

• have low maximum payouts

• end when you leave the job

• use restrictive definitions of disability

Individual policies stay with you, offer more flexible definitions, and provide stronger long-term protection.

Note: Individual disability benefits are tax-free, whereas group plan benefits are often taxable if your employer paid the premiums. This means a private policy dollar is worth more in your pocket.

Why Disability Insurance Matters

A long disability can deplete savings and disrupt retirement plans. Since your income funds every financial goal, protecting it is often more important than life insurance.

Critical Illness Insurance: Lump-Sum Support for Recovery

Critical illness insurance pays a one-time, tax-free lump sum upon diagnosis of a covered condition. These include:

• cancer

• heart attack

• stroke

• organ failure

• multiple sclerosis

• certain neurological disorders

RAMQ covers medical treatment, but not:

• time away from work

• private care

• medical travel

• home support

• additional childcare

A CI payout provides immediate liquidity, preventing recovery from becoming a financial burden.

Typical coverage: 25,000 to 250,000 CAD.

Health and Dental Insurance: Bridging RAMQ Gaps

RAMQ provides core medical coverage, but it has gaps. Private plans help manage predictable, ongoing expenses not covered by RAMQ.

Typical coverage includes:

• drugs not fully covered by RAMQ

• dental cleanings and treatments

• vision care

• physiotherapy, osteopathy, chiropractic

• diagnostic testing

• travel insurance

For families without workplace benefits, private insurance keeps routine costs manageable. For those with group plans, individual add-ons can extend coverage.

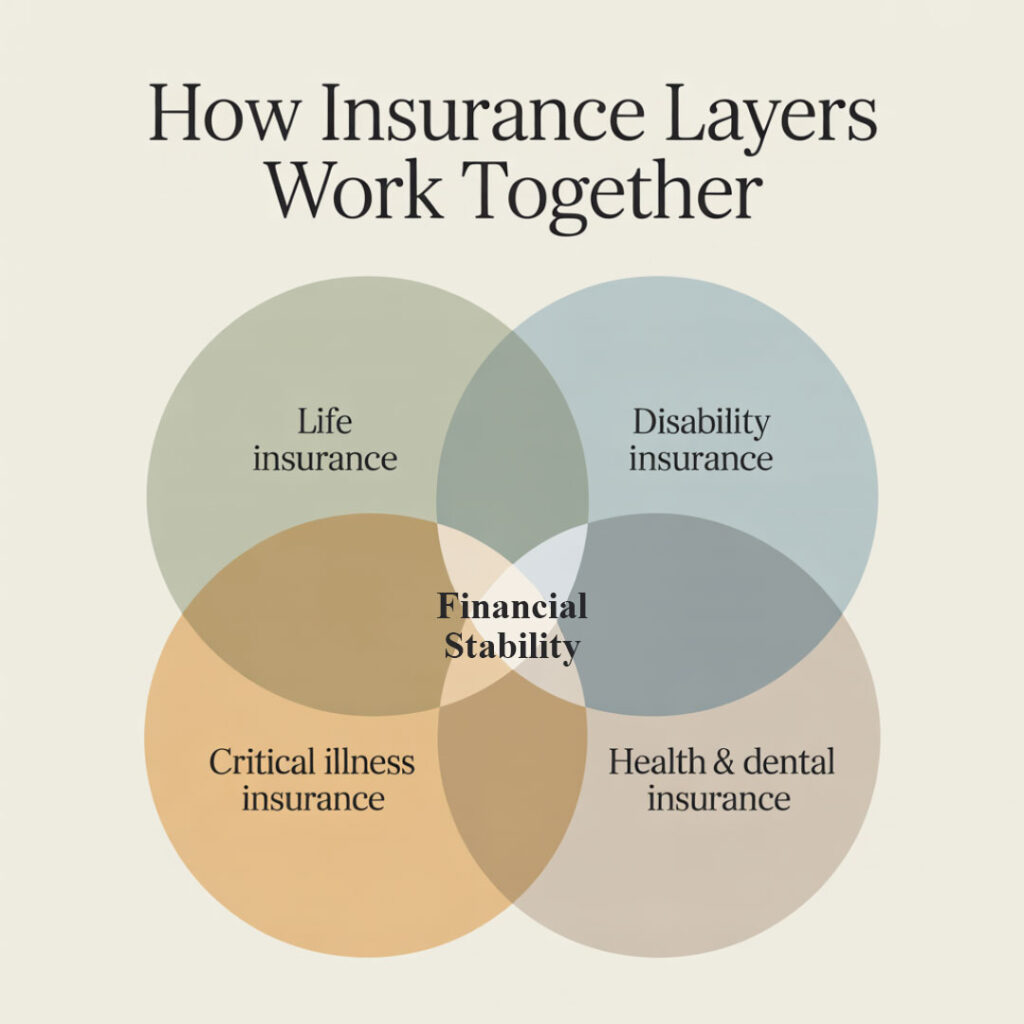

How Essential Insurance Coverages Integrate

A complete protection plan addresses different risks:

Life insurance

Supports your family and long-term financial goals.

Disability insurance

Replaces the income that funds your entire financial plan.

Critical illness insurance

Provides immediate cash for major health events.

Health and dental insurance

Reduces ongoing medical expenses.

Together, these layers protect both short-term stability and long-term planning.

Common Pitfalls When Selecting Insurance in Quebec

Many people in Quebec misunderstand insurance. Frequent mistakes include:

• relying only on employer benefits

• assuming RAMQ covers nearly everything

• choosing the cheapest policy instead of adequate protection

• overlooking disability insurance

• buying mortgage insurance from a bank instead of personal life insurance

• not updating coverage after life changes (home purchase, marriage, children)

Avoiding these mistakes ensures your coverage reflects your actual needs.

Comparison Table: Key Insurance Types in Quebec

| Coverage Type | What It Protects | When It Pays | Benefit Type | Typical Use |

| Life Insurance | Family income, debts, long-term goals | Death | Tax-free lump sum | Mortgage protection, income replacement, estate planning |

| Disability Insurance | Your income | Illness or injury preventing work | Monthly income replacement | Long-term financial stability |

| Critical Illness Insurance | Recovery costs, non-medical expenses | Diagnosis of covered illness | Tax-free lump sum | Time off work, private care, family support |

| Health & Dental Insurance | Costs not fully covered by RAMQ | Ongoing usage | Reimbursement | Dental, vision, drugs, paramedical care |

FAQ

If I already have RAMQ and group benefits through my employer, do I still need personal insurance?

RAMQ and group plans provide a foundation but rarely cover full income replacement, recovery costs, or long-term family goals. Personal life, disability, and critical illness insurance let you customize coverage to your income, debts, and dependents so that a major event doesn’t derail your financial plan.

How do I decide how much life insurance I need in Quebec?

Start by adding your mortgage balance, other debts, income you’d want to replace for your family (often 5–10 years), and future goals such as children’s education. Subtract existing assets and any group coverage. The result is a practical coverage target to review with an advisor. I use a specific Needs Analysis calculator to get this number precise down to the dollar.

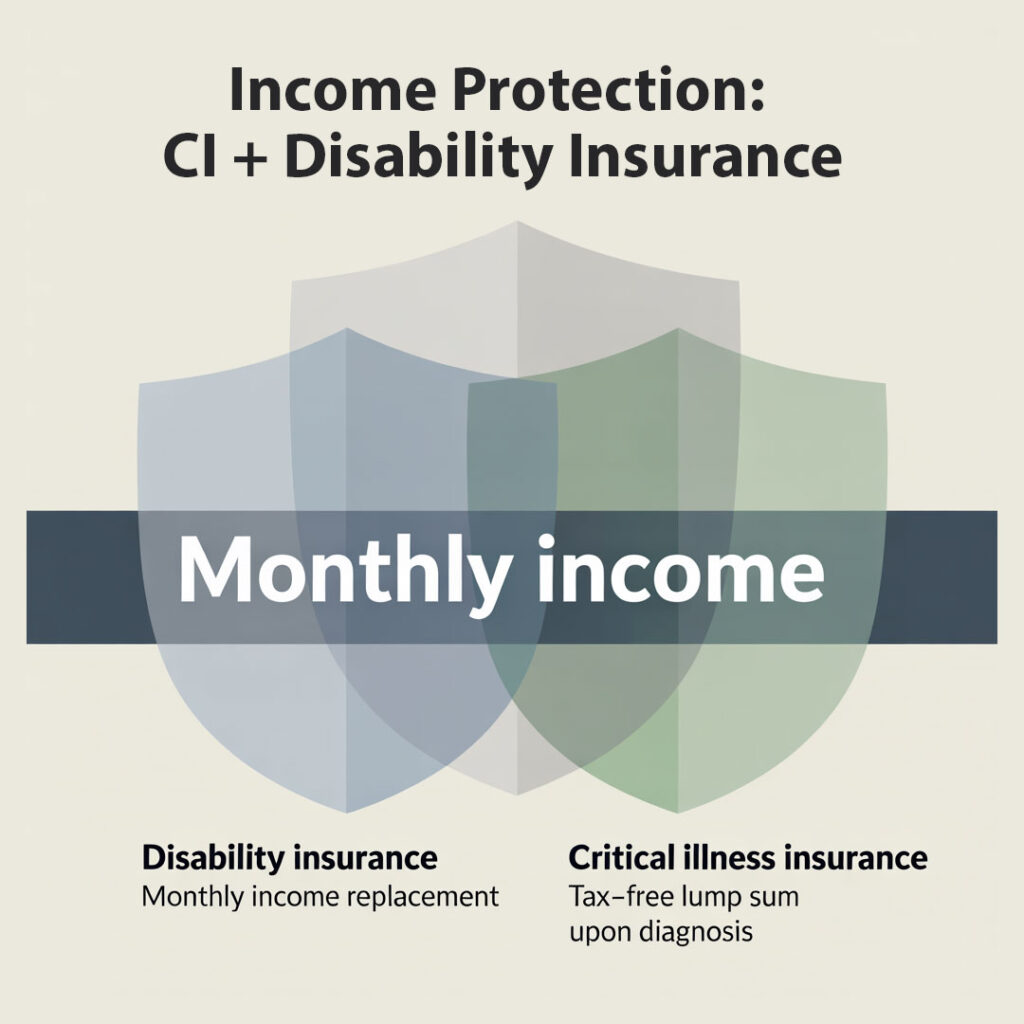

What’s the difference between disability insurance and critical illness insurance?

Disability insurance replaces a portion of your income monthly if illness or injury prevents you from working. Critical illness insurance pays a one-time, tax-free lump sum upon diagnosis of a covered condition, helping with extra costs like private care, time off, or travel for treatment.

Can I rely only on mortgage insurance from my bank?

Bank mortgage insurance mainly protects the lender and is tied to that specific loan. Personal life insurance gives you more control: your family receives the benefit tax-free and can decide whether to pay off the mortgage, maintain lifestyle, or cover other priorities.

When is the right time to review my insurance coverage?

Review your plan whenever you have a major life change—buying a home, having a child, changing jobs, starting a business, or nearing retirement. In Quebec, it’s also wise to revisit coverage when your income or debts change significantly or when your employer benefits are updated.

Ready to Optimize Your Insurance Plan?

If you want to understand your current protection and identify gaps across life, disability, health, or critical illness coverage, schedule a free consultation.

We’ll review your family situation, income, employer benefits, and long-term goals. Then, we’ll build a plan tailored to your needs and budget.

Book your free consultation today and receive a clear, personalized overview of your insurance options.

Phone: (514) 834-5558

Email: contact@bkfinancialservices.ca

Languages: English, French, Russian, Hebrew