Investing often feels overwhelming due to product complexity, fees, and market noise. Many worry about timing, fund selection, or taxes, leading to delayed action. This leaves cash in low-interest accounts, losing purchasing power to inflation.

A simple long-term investment portfolio in Canada doesn't demand guessing hot stocks. It requires a clear plan, appropriate accounts, diversified products, and disciplined habits. For Quebec residents, coordinating investments with tax rules, RRSPs, FHSAs, and mortgages is crucial.

With over 20 years as a Quebec financial planner, I've observed a pattern: focusing on fundamentals generally outperforms chasing complexity. This guide clarifies essential principles. It helps you build and maintain a simple, tax-efficient portfolio to support your retirement and life goals.

Essential Asset Allocation for Your Long-Term Portfolio

For long-term Canadian investors, asset allocation – your mix of stocks, bonds, and cash – drives results. Over 20+ years, this mix often outweighs individual stock selection. A younger investor might hold 80–90% equities, while someone nearing retirement might prefer 40–60% fixed income to reduce volatility.

Canadian investors now access low-cost index ETFs covering Canadian, U.S., and international markets, plus government and corporate bonds. A simple portfolio can be a single "asset allocation ETF" providing automatic diversification. Match its risk level to your time horizon, income stability, and emotional tolerance for market swings.

Strategizing Your Equity and Fixed Income Mix

A common starting point for equity percentage is "100 minus your age," then adjust for personal circumstances. A 35-year-old with stable employment and an emergency fund might target 65–80% equities. A self-employed individual or someone with variable income may opt for a more conservative split, even if younger.

The crucial factor is your ability to remain invested during market downturns. If a 30% portfolio drop triggers panic selling, your allocation is likely too aggressive. Many Quebec clients find value in testing scenarios within a financial plan to determine a suitable mix they can maintain through complete market cycles.

Global Diversification Across Regions and Sectors

Many Canadians are overexposed to domestic companies and sectors like financials and energy. However, Canada represents a small fraction of global markets; heavy home concentration increases risk. Diversifying across Canadian, U.S., and international equities mitigates the impact of any single economy or sector.

Broad-market index ETFs or "all-in-one" funds automatically provide exposure to thousands of global companies. A balanced ETF, for instance, might hold Canadian banks, U.S. technology, European industrials, and emerging markets under one ticker. The goal is long-term global growth participation, not annual regional prediction.

| Portfolio Approach | Pros for Long-Term Investors | Key Considerations in Canada |

| Single asset allocation ETF | Very simple, diversified, auto-rebalanced | Choose risk level; hold in right accounts |

| 3-fund ETF portfolio (CA/US/Intl) | Flexible, transparent, low cost | Requires manual rebalancing |

| DIY stock picking | Potential for outperformance, more control | Higher risk, time-intensive, less diverse |

| Active mutual funds | Professional management | Often higher fees, mixed performance |

Maximizing Tax Efficiency in Your Investment Portfolio

Tax planning is vital for long-term investment portfolios in Canada, particularly for Quebec residents with combined federal and provincial tax rates that remain high as of 2026. The same investment yields varying net results across RRSPs, TFSAs, FHSAs, or taxable accounts. Over decades, tax-efficient account selection can equal portfolio optimization's value.

Aligning your investment strategy with your marginal tax bracket, family situation, and expected retirement income is crucial. High-income earners often maximize RRSP contributions for immediate tax deductions. Lower-income or younger investors may prioritize TFSAs and FHSAs for their tax-free growth and flexibility.

Optimizing RRSPs for Sustainable Long-Term Growth

For many Quebec professionals, RRSPs are a cornerstone of long-term investing. Contributions reduce current taxable income, and investments grow tax-deferred until withdrawal. The true benefit emerges when your retirement withdrawal tax rate is lower than your working-year tax rate.

RRSPs are not always the default first choice. If your current income is modest, the deduction may be less valuable now than it will be later. In such cases, consider contributing but carrying forward the deduction to a higher-income year, or focus on TFSAs short-term.

Coordinating RRSP contributions with pension plans, bonuses, and retirement income splitting can dramatically improve long-term net income.

Leveraging TFSAs and FHSAs for Tax-Free Investing

The Tax-Free Savings Account (TFSA) is often misconstrued as solely a "savings" vehicle. In reality, it's a premier long-term investment account in Canada, offering tax-free growth and withdrawals. This makes it ideal for higher-growth assets like equities, especially for those anticipating rising income and tax rates.

For first-time home buyers, the First Home Savings Account (FHSA) combines top features of RRSPs and TFSAs. Contributions generate an RRSP-like deduction.

However, qualifying withdrawals for a home purchase are tax-free, similar to a TFSA. Coordinating FHSA, the RRSP Home Buyers’ Plan, and mortgage planning helps young professionals and newcomers enter the Quebec real estate market efficiently, in line with the federal rules set out in the Income Tax Act.

The following overview summarizes how key Canadian account types are taxed under current 2026 rules:

| Account Type | Tax on Contribution | Tax on Growth | Tax on Withdrawal | Best Used For |

| RRSP | Deductible (tax refund) | Tax-deferred | Fully taxable as income | Retirement, high earners, income smoothing |

| TFSA | No deduction | Tax-free | Tax-free | Long-term growth, flexibility, emergency fund |

| FHSA | Deductible (like RRSP) | Tax-free | Tax-free if for first home | First home down payment + long-term tax planning |

| Non-registered | No deduction | Taxable annually | Capital gains/dividends taxed | Overflow investing, specific planning strategies |

Understanding Investment Costs and Fees in Canada

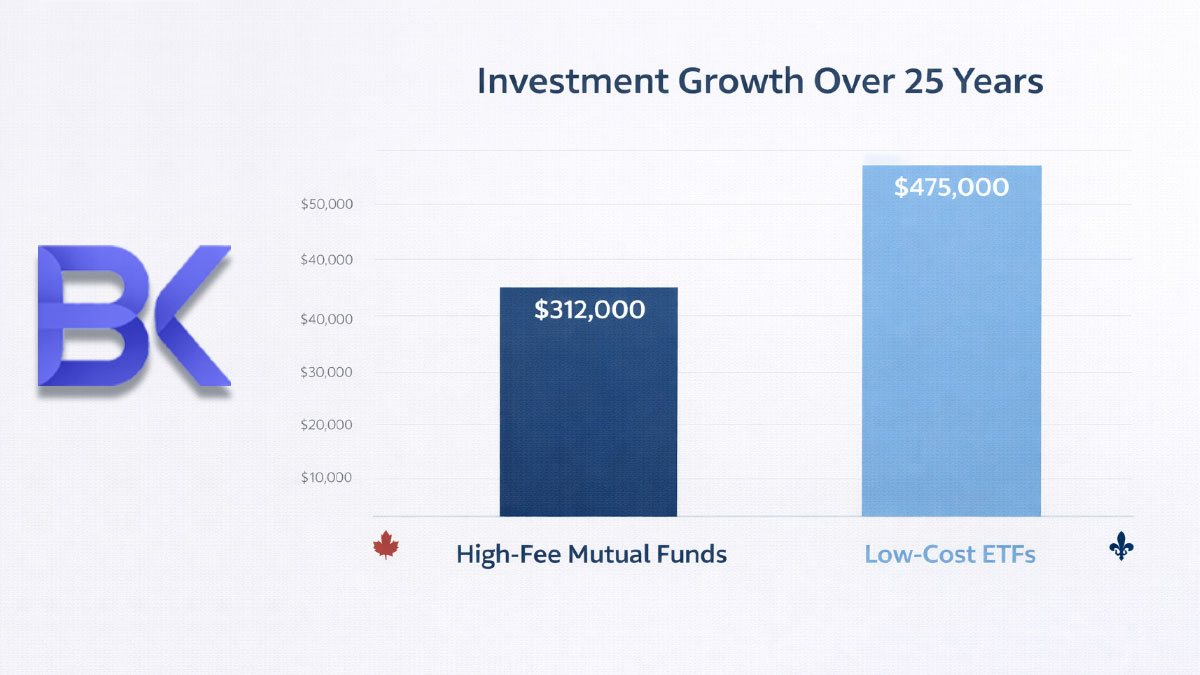

Canadian investment fees can subtly erode long-term returns. A small annual difference, like 2% versus 0.25%, compounds significantly over decades. For example, on a $200,000 portfolio returning 6% gross over 25 years, the lower-fee option can add tens of thousands of dollars.

Many Canadian mutual funds still charge Management Expense Ratios (MERs) of 2% or more. In contrast, broad-market ETFs and some index mutual funds often cost under 0.30%.

Choosing cost-effective investments that match your risk profile and staying the course generally beats trying to "outsmart" the market with high-fee products.

Navigating MERs, Trading Costs, and Hidden Expense

Beyond MERs, investors must understand trading commissions, currency conversion, and advisory fees. Some "no-fee" platforms may still profit via wider currency spreads or product selection. Quebec residents working with an advisor should clarify if they are paying embedded commissions or transparent, fee-based advice.

A simple long-term portfolio doesn't necessitate frequent trading. Rebalancing annually or semi-annually, and adjusting for life changes, is typically sufficient. Minimizing unnecessary transactions reduces both costs and emotional decision-making. Periodically reviewing your investment fee structure is a practical step to enhance overall returns.

When Professional Fees Offer Value Beyond Product Costs

Higher fees can be reasonable in some situations. Active strategies, specialized mandates, or private investments might add value, but require careful evaluation. More often, professional guidance offers greatest value through financial planning, tax optimization, behavioral coaching, and coordinating mortgages, insurance, and retirement income.

For many Quebec individuals and families, combining low-cost investment products with personalized planning support offers a robust middle ground. The portfolio remains efficient, and crucial decisions about taxes, debt, and cash flow are addressed with clarity, not guesswork.

Cultivating Discipline and Smart Behaviour in Investing

Even the best-designed portfolio fails if the investor cannot adhere to it through market fluctuations. Behavior – your reaction to volatility, news, and social pressure – often impacts results more than product selection. In 2020, 2022, and other volatile periods, many investors sold at lows, missing subsequent recoveries.Referencing the AMF’s guide to investing basics can help you stay grounded in the fundamentals and avoid scams or emotional decisions.

A simple, rules-based investment plan safeguards against emotional decisions. This involves setting target allocations, automatic contributions, and clear guidelines for making (or not making) changes. It also requires understanding that temporary declines are a normal part of the long-term growth trajectory.

Automating Your Contributions and Portfolio Rebalancing

Automatic monthly contributions to RRSPs, TFSAs, or FHSAs align investing with your paycheque, eliminating "market timing" stress. This works well for young professionals and self-employed individuals who might otherwise delay. Over time, you buy more units at lower prices and fewer at higher prices, smoothing entry points.

Rebalancing once or twice yearly restores your portfolio to its intended mix. If equities outperform, you trim them and add to bonds or cash, systematically "selling high and buying low." This scheduled approach, rather than emotional actions during market turmoil, is a powerful habit for long-term success.

Aligning Your Investment Portfolio with Life Goals

A portfolio is more than numbers; it supports real goals: buying a first home, educating children, reducing work hours, or retiring comfortably in Quebec. Matching each goal to a time horizon and risk level helps keep your strategy realistic.

Money needed in three years for a down payment, for instance, should not face the same risk as money for retirement 25 years away.

Quebec Success Stories: Simplifying for Long-Term Investment Results

Case 1: Young Professional Couple in Montreal

A Montreal couple in their early 30s, both salaried, had scattered investments: various bank mutual funds, a high-fee group RRSP, and cash for a future home. They struggled to prioritize RRSPs, TFSAs, or down payment savings, incurring overall fees around 2.1% annually.

I mapped their goals: buy a condo in 5–7 years, maintain parental leave flexibility, and build retirement savings. Accounts were consolidated into a simple structure: FHSA and TFSA for the home, low-cost asset allocation ETFs for RRSP investing, and a clear, paycheque-aligned contribution plan. Fees dropped below 0.40%.

Over three years, despite market volatility, they remained invested due to their clear plan. Home savings stayed on track, portfolios grew tax-efficiently, and they understood each account's role. The key improvement was not a "hot" investment, but implementing a simpler, disciplined structure.

Case 2: Self‑Employed Professional in Laval

A self-employed Laval consultant in his mid-40s faced irregular income, a mortgage, and a growing non-registered stock portfolio. He felt overwhelmed by tax slips, uncertain about RRSPs, and anxious about retirement. His portfolio was concentrated in few sectors, leading to large trades based on market news.

I first analyzed his cash flow and Quebec tax situation. Then, we designed a plan: establish a robust emergency fund, set up automatic monthly contributions to a diversified ETF portfolio (RRSP/TFSA), and gradually reduce risky concentrations. I also implemented tax strategies, including optimal RRSP contributions during high-income years.

Within two years, his portfolio was more diversified, with lower volatility and improved tax efficiency. Crucially, he experienced less market stress and gained a clearer retirement trajectory. The "win" stemmed from simplifying investments and connecting them to a realistic long-term plan.

FAQ

1. How much do I need to start a simple long‑term investment portfolio in Canada?

You can start with a few hundred dollars in a TFSA, RRSP, or FHSA and contribute regularly. Consistent contributions matter most, not the initial lump sum.

2. Is an RRSP or TFSA better for long‑term investing in Quebec?

It depends on your current and future tax brackets. RRSPs often provide more benefit if you're in a higher tax bracket now and anticipate a lower one in retirement. TFSAs may be better for moderate income or valuing flexibility. A mix of both is often ideal.

3. Are all‑in‑one ETFs a good choice for a simple portfolio?

Yes, for many Canadians, they offer an excellent way to achieve diversified global exposure and automatic rebalancing in one product. The key is selecting a version whose risk level matches your goals and time horizon.

4. How often should I change my long‑term investment strategy?

Your core strategy should change rarely, primarily when life circumstances, goals, or risk tolerance shift. Tactical market-based shifts usually harm long-term results. Annual reviews suffice for most investors.

5. Can I manage my long‑term portfolio alone, or do I need a financial planner?

You can manage it alone if you understand asset allocation, taxes, and your own behavior. However, many Quebec residents benefit from professional guidance to integrate investments with tax planning, mortgages, insurance, and retirement income, avoiding emotional mistakes.

Ready to Optimise Your Long‑Term Investment Portfolio in Canada?

Free Consultation:

Phone: +1‑514‑834‑5558

Email: contact@bkfinancialservices.ca

Site: https://bkfinancialservices.ca

Book Free Consultation Today – Available in English, French, Russian, Hebrew

Disclaimer: This article is provided for general informational purposes only and does not constitute individual financial, investment, or tax advice. The information is current as of 2026 and may change. Past performance of markets or financial products is not indicative of future results. Investment values can fluctuate, and you may lose principal. Before making any investment decisions, please consult with a qualified financial advisor to discuss your specific risk tolerance, time horizon, and financial goals.