A 5–10 year window is long enough to make real progress and short enough to plan with confidence. It’s the ideal time frame for goals like buying a home, paying off debt, building an education fund, or achieving partial financial independence. Yet, most people skip the middle ground – they think only in months (“pay bills, save a bit”) or in distant decades (“retirement someday”).

This guide explains how to set goals that are grounded in numbers, adjusted for taxes in Quebec, and flexible enough to survive real life. You’ll learn to define outcomes clearly, translate them into funding targets, choose the right accounts, use Quebec’s tax perks like FHSA deductions and QESI grants and build a routine that keeps you accountable. Based on plans for 200+ local families, here’s your roadmap.

Step 1. Choose outcomes, not wishes

Before you think about numbers or accounts, you need clarity. A vague idea like “I want to save more” is not a goal — it’s a wish. Goals must be concrete, measurable, and personally meaningful.

Start with no more than three core goals for the next decade. More than that will dilute focus. Typical examples include:

- Buying your first or next home in Quebec

- Paying off all consumer debt and reducing your housing cost ratio below 30% of income

- Building an investment portfolio that covers 30–40% of your monthly expenses

- Fully funding a child’s university education

- Creating a business emergency fund equal to six months of expenses

Each goal should pass five filters: it has a clear time frame (within 5–10 years), a realistic amount in dollars, an identified source of funding, and a protection layer such as insurance or a cash buffer.

When your goals are written this way, you transform good intentions into targets you can plan around.

What I can do for you: I help refine your top 3 in a quick audit.

Step 2. Translate goals into numbers you can actually fund

Every financial dream either succeeds or fails in the math. Once you know what you want, calculate how much, how long, and from where.

Home down payment example

Suppose you plan to buy a home for 550,000 CAD (avg Montreal condo 2025) within seven years. You’ll likely need 15% for the down payment plus 3–4% for closing and moving costs, or roughly 103,000 CAD total.

To reach this in three years at an average annual return of 6-7%, you would need to save 1,150 CAD per month.

You’d start with the FHSA (tax-deductible contributions and tax-free withdrawals), then use the RRSP Home Buyers’ Plan for additional funds, and finally TFSA for flexibility.

Retirement “level one” example

If you spend 3,500 CAD monthly today, your target might be to cover 35% of that through investment income — around 1,225 CAD per month. With a 3.5% safe withdrawal rate, you’d need about 420,000 CAD in 8 years.

To reach it from zero, a balanced portfolio with 8-10% annual growth would require roughly 3,200–3,600 CAD in monthly savings. Adjust if you already have assets or an employer pension.

Education fund example

A 10-year education goal for one child typically needs 25,000–35,000 CAD in today’s dollars. Using a Registered Education Savings Plan (RESP), government grants of up to 7,200 CAD can cover part of the gap. A monthly contribution of 125–200 CAD usually suffices with moderate growth.

The point isn’t to memorize these figures — it’s to see that every realistic goal starts with arithmetic, not emotion.

What I can do for you: My cash-flow tool sizes this precisely for your income.

Step 3. Pick the right accounts in Quebec (FHSA, RRSP, TFSA, RESP, RDSP)

The tax system shapes every financial plan. Quebec residents have access to both federal and provincial incentives, and choosing the right account can change your outcome dramatically.

- FHSA (First Home Savings Account): Ideal for first-time buyers. Contributions are deductible like RRSPs, withdrawals for a qualifying home are tax-free like a TFSA. You can contribute up to 8,000 CAD per year, to a lifetime limit of 40,000 CAD.

- RRSP (Registered Retirement Savings Plan): Best for long-term savings. It lowers taxable income now and allows tax-deferred growth. Withdrawals are taxed later, ideally when your income is lower. If used for the Home Buyers’ Plan, you must repay the withdrawn amount over 15 years.

- TFSA (Tax-Free Savings Account): Excellent for mid-term flexibility. Contributions are not deductible, but all gains and withdrawals are tax-free. Ideal for emergency reserves or goals within 5–10 years.

- RESP (Registered Education Savings Plan): Provides government grants of 20% (and sometimes more) on annual contributions. Family plans allow sharing the grant between multiple children.

- RDSP (Registered Disability Savings Plan): If you or a dependent qualify for the Disability Tax Credit, this account provides some of the most generous matching grants in Canada.

Using these accounts in sequence — starting with FHSA and RESP for targeted goals, then RRSP and TFSA for longer-term growth — gives you tax efficiency and flexibility at once.

What I can do for you: I help clients max FHSA + RESP grants in one setup – book a call to check your room.

2025-2026 Account Limits for Quebec Goals

| Goal (5-10 Years) | Top Account | 2025 Limit | Quebec Bonus |

| First Home | FHSA | $8,000/yr, $40k lifetime | Pairs with RRSP HBP ($60k loan) + 16.5% abatement boost |

| Retirement/Independence | RRSP | 18% of income, max $32,490 | QPP projections enhance deferral value |

| Emergency/Buffer | TFSA | $7,000 new room | Tax-free growth on high-interest savings (up to 4.6%) |

| Child Education | RESP | No contribution limit | CESG 20% ($500 max) + QESI 10% ($250 max, $3,600 lifetime) |

| Disability Support | RDSP | Varies by income | Grants up to $3,500/yr for low-income |

QPP’s enhanced contributions mean bigger future pensions, so RRSP timing aligns better with your marginal rate (48-53% in Quebec).

Step 4. Size your monthly savings and set guardrails

Most plans fail not because they’re unrealistic but because they’re underfunded. Setting a consistent savings rate is the backbone of progress.

For a balanced financial life in Quebec:

- Start at 20% of net income if your employment and income are stable.

- Increase to 25–30% if you’re self-employed or your income fluctuates. Build a six-month emergency reserve first.

- If you carry high-interest debt, temporarily reduce savings to 10–15% and focus on eliminating balances above 8–10% interest rates.

Create a logical funding sequence:

- Build an emergency fund of 3–6 months of essential expenses.

- Capture RESP grants if you have children.

- Contribute to FHSA and RRSP for home savings or long-term goals.

- Use TFSA for flexibility and medium-term goals.

- Once these are funded, consider extra mortgage payments or non-registered investments.

Every dollar should have a clear role. Treat savings like rent — automatic and non-negotiable.

What I can do for you: I use a Priority Funding Matrix to ensure RESP grants and FHSA deductions are captured before overflow goes to TFSA, maximizing cash flow.

Step 5. Choose an investment mix that matches your time and risk

For 5–10 year goals, you need growth but cannot afford large drawdowns right before withdrawal. That’s where asset allocation comes in.

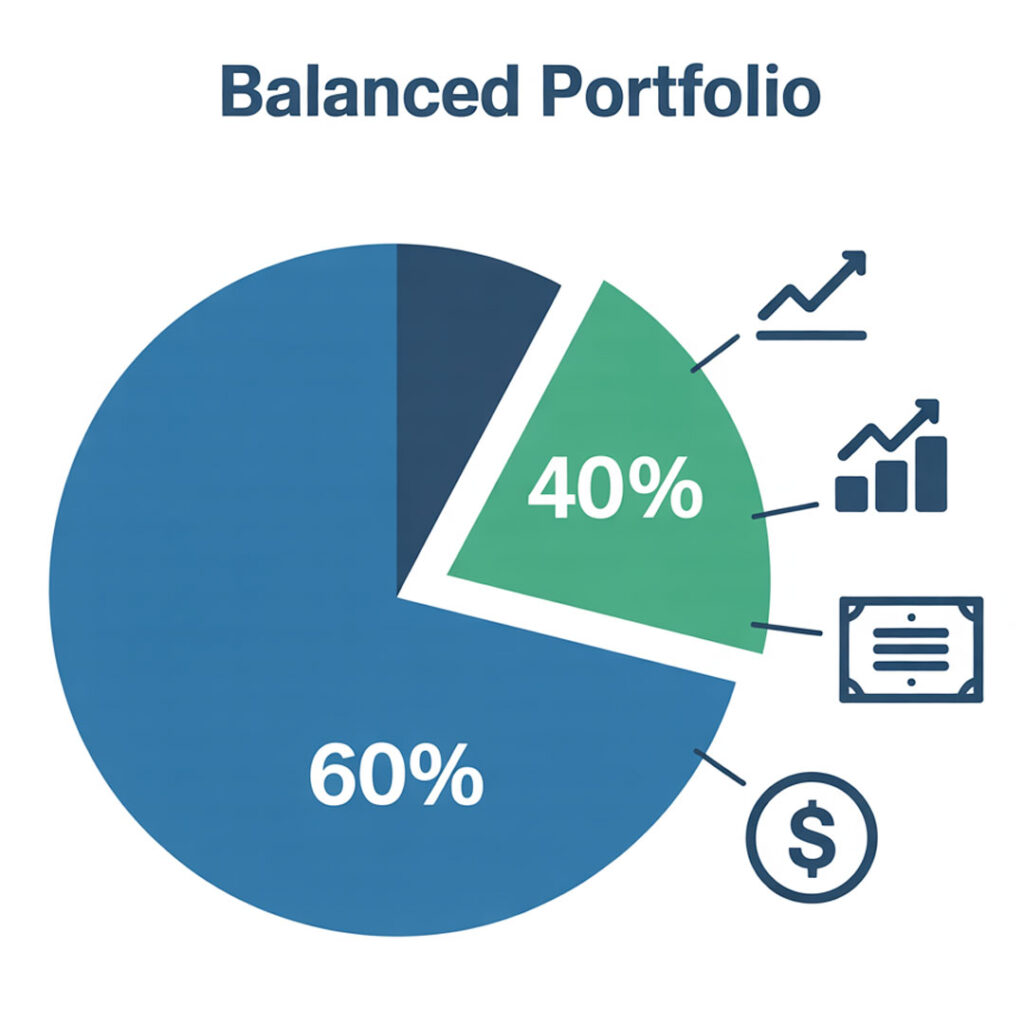

A balanced portfolio (about 60% equities, 40% fixed income and cash) works for most mid-range goals — it offers moderate growth with manageable volatility. Those with higher risk capacity and longer horizons may go up to 70–80% equities, but they must reduce exposure two to three years before the goal date.

Use liquidity buckets:

- Keep money you’ll need in the next 1–2 years in cash or short-term bonds.

- Invest years 3–7 in diversified ETFs or mutual funds that balance equities and bonds.

- Hold long-term growth assets (stocks, global equity funds) for goals beyond 7 years.

Avoid putting emergency or home-purchase money into volatile assets. Markets can recover over time — but only if you don’t need the cash when they’re down.

What I can do for you: I can run your portfolio mix through my risk model (free audit saves 20-30% volatility). I structure your liquidity buckets using ETFs and segregated funds to protect capital needed within 3 years while targeting 10-12% growth on long-term assets.

Step 6. Put protection around your plan

Even a perfect financial plan can unravel after one health or income shock. Protection isn’t just about insurance; it’s about ensuring that one bad year doesn’t erase ten good ones.

- Life insurance should cover debts, replace income for dependents, and secure future goals like education.

- Disability insurance protects your earning power, often your most valuable asset. In Quebec, provincial programs like QPP offer partial coverage, but it’s rarely enough.

- Critical illness insurance provides a lump sum to cover treatment costs or time off work.

- Review your group benefits — many employees assume they have sufficient coverage, but limits are often low.

- Legal preparation: keep an up-to-date will and protection mandate (mandat de protection) prepared by a Quebec notary.

- QPIP for parents: Factor in Quebec Parental Insurance Plan premiums when sizing disability coverage—self-employed can deduct up to 75%.

Think of insurance as the stabilizer that keeps your plan intact during turbulence.

What I can do for you: I conduct an independent Needs Analysis for Life, CI and Disability, comparing quotes from 15+ carriers to ensure you get your coverage at the best rate.

Step 7. Track your progress regularly

Consistency beats intensity. Reviewing your plan twice a year keeps small issues from becoming crises.

- Monthly snapshot: Track net income, savings contributions, debt balances, and account values. This keeps awareness high.

- Semiannual review: Revisit your asset allocation, RRSP/TFSA contribution room, QPP retirement projections, and insurance coverage. Adjust when income or expenses change.

In the digital age, you can automate this process using budgeting apps like YNAB or Monarch Money, or work directly with a planner who updates projections each quarter.

The goal isn’t to chase perfection; it’s to stay directionally correct and course-correct quickly.

What I can do for you: Clients receive a scheduled, semi-annual Tune-Up Call where we review contribution room, rebalance investments, and update projections for QPP/QESI changes.

When the math doesn’t work yet

If your savings target feels impossible, that’s normal — almost everyone starts there. You can always adjust four levers:

- Extend the timeline. Buying a home in 8 years instead of 6 might reduce the required savings by 20–30%.

- Adjust the target. A 450,000 CAD home instead of 500,000 CAD may make the plan viable.

- Add income. Even an extra 300 CAD per month can fund an RESP or emergency buffer.

- Reduce waste. Audit subscriptions, insurance premiums, and bank fees — most households can trim 100–200 CAD monthly without lifestyle damage.

Financial goals are living documents, not rigid contracts. The key is to maintain momentum, even if the pace changes.

Example timeline and account map

| Year | Milestone | Account focus | Risk action | Quebec Twist |

| 0–1 | Build 3–6 month cash buffer | HISA, TFSA if room | Stay fully liquid | QPP opt-out if 65+ |

| 1–3 | Begin saving for home and retirement | FHSA first, RRSP second, RESP if children | Balanced portfolio, annual rebalance | QESI claim by June |

| 3–5 | Midpoint review | Add TFSA overflow, review grants | Gradually reduce risk if home date fixed | Abattement check |

| 5–7 | Home purchase window | FHSA withdrawal, RRSP HBP, TFSA | Shift home funds to low-volatility assets | QPIP for parents |

| 7–10 | Consolidation and growth | RRSP and TFSA, RESP ongoing | Rebalance portfolio, review estate plan | Estate notary |

Common mistakes to avoid

- Setting goals without a time frame or number

- Mixing emergency cash with investments

- Ignoring contribution limits or overcontributing to RRSP/TFSA

- Using one account for several unrelated goals

- Keeping 100% equity exposure close to your withdrawal date

These errors are simple to avoid once you have structure and review points.

5 Quebec-Specific Pitfalls in 2025

- Ignoring 5.9% rent hikes – build buffers assuming 6% annual creep.

- Skipping QESI application – miss $3,600/child lifetime.

- Over-relying on group benefits (QPP covers only ~50% income replacement).

- Not leveraging abatement for RRSP (extra 16.5% federal savings).

- Forgetting protection mandate – vital for Quebec estate planning.

FAQs

How do I choose a realistic return rate for the next decade?

Base your plan on conservative assumptions. For balanced portfolios, use 7-8% annual growth after fees. For stress-testing, model 3–4%. If the plan still works at the lower end, you’re in safe territory.

RRSP or TFSA for a 7-year goal?

It depends on your income. If you’re in a higher tax bracket and expect lower income later, RRSP offers immediate tax savings. If you want flexibility and tax-free withdrawals, TFSA is safer. Many Quebec households split contributions between both.

Can I combine FHSA and the RRSP Home Buyers’ Plan?

Yes, and you should if possible. FHSA withdrawals are tax-free and don’t require repayment. RRSP HBP withdrawals are tax-free initially but must be repaid within 15 years. Used together, they expand your home-purchase budget significantly.

What savings rate should I aim for as a self-employed person?

Plan for 25–30% of net income. Because income can fluctuate, keep six months of expenses in reserve. Also, consider disability and health coverage outside of employer plans.

How often should I rebalance investments?

Twice a year is ideal. Rebalance if any asset class drifts more than 5% from its target or when you are within two years of spending the money.

How does 5.9% rent inflation affect my goals?

Factor 6% annual into buffers—e.g., $3,500/mo today becomes $4,700 in 10 years. I model this in plans.

QPP changes for 2025: Impact on retirement goals?

Higher YMPE ($71,300) means more contributions but bigger pensions—prioritize RRSP if in 37%+ bracket.

Self-employed in Quebec: Savings rate tweaks?

Aim 25-30% net, plus QPIP deductions—structure via corp for 10-15% tax savings.

How does “Asset Location” save me money in Quebec?

Asset location is the strategy of holding investments with the worst tax treatment (like bonds generating 100% taxable interest income) inside your tax-sheltered accounts (RRSP/TFSA). Conversely, assets with the best tax treatment (like stocks generating capital gains or eligible dividends) are held in non-registered accounts. This is especially beneficial in Quebec, where combined marginal tax rates are high (up to 53%), making tax efficiency a top priority. I help clients model this strategy to minimize tax drag over the 5–10 year horizon.

Quick checklist

- Define three primary goals for the next decade

- Quantify them in today’s dollars and calculate the monthly savings needed

- Use FHSA, RRSP, TFSA, and RESP strategically

- Match your investment mix to your timeline and risk

- Protect your plan with insurance and legal documents

- Review your progress monthly, rebalance twice a year

Turn These Steps into Your Custom 2025-2035 Roadmap

Together, we can calculate your targets, choose the right accounts, and build a plan that grows with you — not against you. In 60 mins, we’ll crunch your numbers (home at $550k? RESP at $30k?) and stress-test for rent spikes/QPP.

I consult in English, French, Russian, Hebrew.

Book Now Your First Free Consultation

Important notice

This article is intended to provide general information for educational purposes only. It does not replace personalized financial advice. Account rules, tax brackets, and contribution limits may change, and investment values may fluctuate. Before making any financial decisions, always confirm your strategies with a licensed financial planner and a tax professional.