Introduction:

Quebec’s rising post-secondary costs concern many families. Fortunately, Ottawa and Quebec offer generous education grants, accessible through a properly utilized Registered Education Savings Plan (RESP).

Combining the federal Canada Education Savings Grant (CESG) with the Quebec Education Savings Incentive (QESI) significantly enhances education savings. The key is understanding optimal contribution timing, amounts, and sequencing, especially for multiple children.

This guide details how RESP, CESG, and QESI integrate to maximize government grants for Quebec parents. It also shows how to coordinate RESP strategies with overall financial planning, taxes, and cash flow.

At a Glance

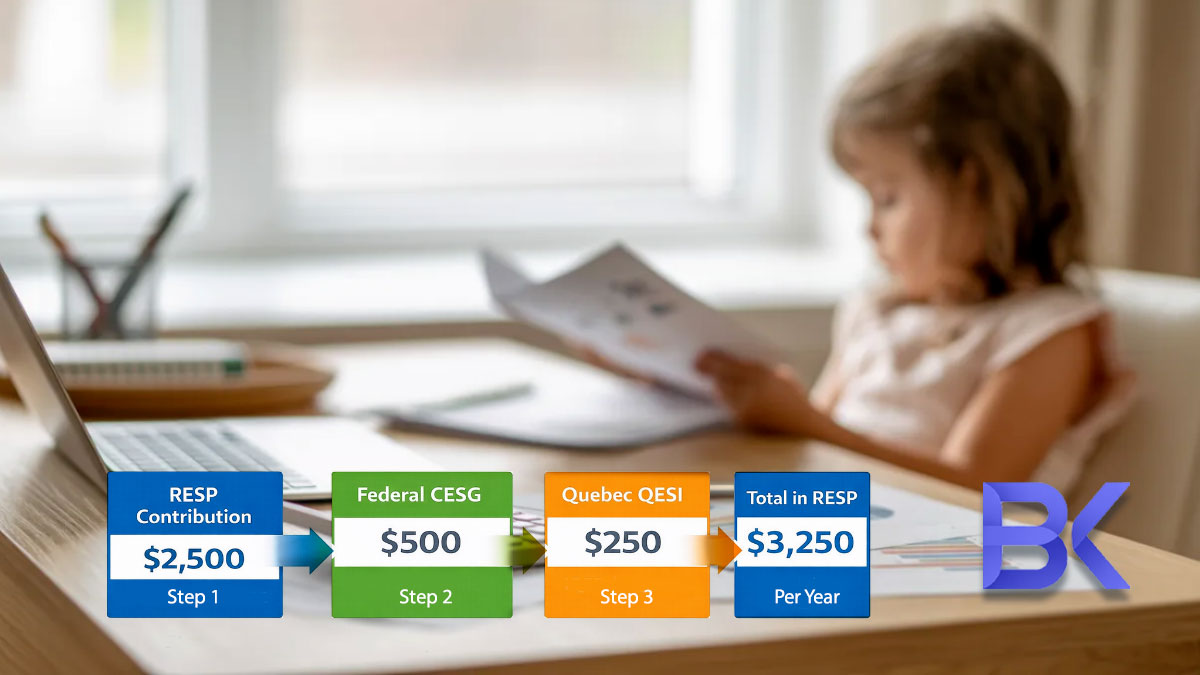

- Contribute $2,500 per year per child to your RESP.

- Earn up to $500 from CESG and $250 from QESI — that’s a 30% guaranteed return before any investment growth.

- Combine both grants strategically to fund CEGEP, university, or trade school costs with minimal tax impact.

Understanding RESP Basics for Education Savings

An RESP is a registered account that allows investments to grow tax-deferred until your child goes to a qualifying post-secondary program. In Quebec, most families use individual or family RESPs to combine long-term growth with access to CESG and QESI.

For 2026, you can contribute up to a lifetime maximum of $50,000 per beneficiary into an RESP. There is no annual contribution limit, but the annual grant limits from CESG and QESI create an “optimal” contribution range you should target each year.

RESP withdrawals comprise tax-free contributions and taxable Education Assistance Payments (EAPs) for the student. Early planning of contributions and withdrawals with a financial planner can significantly reduce overall family tax.

Optimal RESP Contribution Strategies

The core strategy to maximize education grants starts with understanding the ideal annual contribution. For many Quebec families, contributing at least $2,500 per year per child secures the full regular CESG for that year.

Missed years allow catching up on unused CESG room by contributing up to $5,000 annually per child. However, you only receive two years of CESG at a time. A consistent, long-term contribution plan is thus more effective than sporadic deposits.

Integrating RESPs into Quebec Family Budgets

RESP contributions must fit into your family budget alongside mortgages, RRSPs, FHSAs, and debt payments. Many Quebec households use tax refunds from RRSP contributions or tax savings from childcare deductions to fund RESP deposits.

A paycheque analysis can help determine how much you can safely automate into an RESP every month without creating cash-flow stress. Spreading $2,500 over 12 months (about $208/month) is often easier than finding a lump sum at year-end.

OPTIONAL COMPARISON TABLE (adapted to RESP, CESG and QESI)

| Feature | RESP Contributions | Education Assistance Payments (EAPs) |

| Tax on withdrawal | No tax (you already paid tax on money) | Taxable in student’s hands |

| Source of money | Your deposits, transfers, gifts | CESG, QESI, growth, income in the account |

| Ideal withdrawal timing | Anytime, even if child doesn’t study | Only when enrolled in eligible program |

Maximizing the Canada Education Savings Grant (CESG)

The Canada Education Savings Grant is the core federal incentive inside an RESP. For Quebec parents, maximizing CESG is usually step one, then adding QESI on top.

The standard CESG pays 20% on the first $2,500 of annual RESP contributions per child, up to $500 per year. Over time, the lifetime maximum is $7,200 per beneficiary. Lower- and middle-income families may qualify for an additional CESG of 10–20% on the first $500 contributed, based on family net income.

In practice, this means every $2,500 you contribute for your child in a year can generate between $500 and $600+ in federal grants alone, which then grow tax-deferred along with your investments.

CESG Catch-Up Rules and Eligibility

If you start late, you can recover some CESG room, but not all at once. The rules allow you to earn CESG on up to $5,000 of contributions in a year, representing the current year plus one previous unused year.

For a child aged 10 or older without an RESP, a year-by-year plan is needed to prioritize CESG before they turn 17.

The final CESG eligibility year is when the child turns 17. Special contribution requirements apply at ages 15-16 to qualify, making early planning crucial.

Unlocking Income-Tested Additional CESG

Families with modest Quebec incomes can receive extra CESG amounts, but these depend on your net family income as reported on your federal and Quebec tax returns. Coordinating RESP contributions with tax planning – such as RRSP contributions that reduce net income – can sometimes improve your eligibility for these additional grants.

An advisor who understands both tax preparation and RESPs can help determine if shifting income, deductions or credits may unlock more CESG for your children.

Understanding the Quebec Education Savings Incentive (QESI)

The Quebec Education Savings Incentive is a provincial tax credit paid directly into your child’s RESP, not to you personally. This makes QESI a powerful complement to CESG for Quebec families.

QESI provides a basic 10% credit on the first $2,500 of annual RESP contributions, up to $250 per year, plus potential additional amounts for lower-income households. The lifetime QESI maximum per beneficiary is $3,600.

Because QESI is tied to contributions made to a qualifying RESP with a financial institution registered with Revenu Québec (Quebec Revenue Agency), it’s important to ensure your RESP provider is properly set up to receive it.

Important Timing Distinction:

Unlike the federal CESG, which is typically deposited into the account monthly (4–8 weeks after your contribution), the QESI is deposited only once a year. It generally arrives in the spring of the following calendar year. Do not be concerned if you see the federal grant appear quickly while the Quebec credit takes months to show up on your statement.

Ensure your RESP provider is properly registered for QESI deposits. If you’re unsure, I can verify and optimize your setup.

Coordinating QESI with CESG for Maximum Grants

The optimal annual contribution for maximizing both CESG and QESI in Quebec is typically $2,500 per child, which can trigger:

• Up to $500 in basic CESG

• Up to $250 in basic QESI

For many households, this turns $2,500 into roughly $3,250 in the RESP each year, before any investment growth. Higher contributions may still be useful for growth, but will not boost basic grant amounts for that particular year beyond their maximums.

If you have limited cash flow, a planner can help you decide whether to prioritize hitting the $2,500 RESP target, or balancing RESP with RRSP or FHSA contributions, depending on your tax bracket and goals.

Comparison Table: CESG vs QESI (Quebec)

| Feature | CESG (Federal) | QESI (Quebec) |

| Basic grant/credit rate | 20% on first $2,500 | 10% on first $2,500 |

| Max per year | $500 (basic) + possible additional | $250 (basic) + possible additional |

| Lifetime maximum | $7,200 per child | $3,600 per child |

| Paid to | Child’s RESP | Child’s RESP |

| Based on family income | Yes, for additional CESG | Yes, for additional QESI |

Strategic Investment Choices Within Your RESP

Once you capture CESG and QESI, the next lever is how you invest inside the RESP. Quebec parents can choose from mutual funds, ETFs, GICs, savings accounts, and more, depending on their provider.

Because grants and growth compound over many years, starting with a growth-oriented portfolio when your child is young and gradually reducing risk as CEGEP or university approaches is a common strategy. This “glide path” can be customized based on your risk tolerance and the time horizon until withdrawals begin.

Balancing Risk and Time Horizon for Quebec Families

For a newborn, you might have 17–20 years before taking out Education Assistance Payments. In that period, a diversified portfolio with equities can significantly amplify the benefit of CESG and QESI, especially if markets grow faster than inflation.

When your child is 14–16, you may want to protect the grant and growth already accumulated. Many families gradually shift to more conservative investments, such as short-term bonds or GICs, to reduce the risk of market downturns just before tuition is due.

A financial planner with experience in investments and Quebec taxes can integrate RESP choices with your RRSP, TFSA, FHSA and non-registered investments, so your overall risk and tax exposure remain balanced.

Tax-Efficient RESP Withdrawal Planning

Maximizing grants is crucial; however, tax-efficient withdrawal of RESP funds during post-secondary studies is equally important. Education Assistance Payments (EAPs) include CESG, QESI, and investment growth, and are taxable to the student.

Because most full-time students have low income and access to tuition and education tax credits, EAPs often generate little or no actual tax payable. Still, careful planning can minimize surprises and ensure you don’t leave unused grants in the plan.

Structuring RESP Withdrawals for Optimal Tax Efficiency

A typical strategy in Quebec is to withdraw more EAPs in the early years of study while the student’s income is very low and tuition credits are building up. This uses CESG and QESI efficiently and avoids issues if the child later reduces course load or stops studying.

If your child does not pursue eligible studies, RESP rules allow tax-free return of contributions. Accumulated income can sometimes transfer to an RRSP within limits.

However, some CESG and QESI funds must be repaid. An early exit strategy can save significant money.

Graduation shouldn’t come with tax surprises. Let’s plan your first withdrawal strategy together – contact me for a personalized forecast.

2 Real Cases: BK Financial Experience with RESP, CESG and QESI

Case 1 – Late start, child age 13, catching up CESG and QESI

A Quebec family contacted BK Financial when their daughter was 13 and they had no RESP in place. They were worried they had “missed the boat” on government grants.

Boris Kolodner reviewed their income, tax situation, and savings capacity. He built a four-year catch-up plan that prioritized $5,000 annual contributions to capture both current and past CESG, plus QESI on each year’s contributions. They coordinated RRSP contributions to generate tax refunds, which were redirected to the RESP.

By age 17, the family had obtained nearly the maximum CESG and a substantial portion of the available QESI, building a five-figure education fund in time for CEGEP and university, without straining their monthly budget.

Case 2 – High-income professionals balancing RRSP, FHSA and RESP

A pair of young professionals in Montreal, both with high incomes, came to BK Financial after the birth of their first child. They wanted to buy a home, save for retirement, and maximize education grants, but cash flow felt tight.

Boris conducted a full paycheque and tax analysis. He recommended maximizing FHSA and RRSP contributions to reduce their taxable income, then using part of the resulting tax refunds to fund $2,500 annual RESP contributions for their child, hitting the optimal CESG and QESI amounts.

Over the following three years, this integrated strategy increased their net after-tax wealth, accumulated a home down payment, and built a growing RESP that captured all available grants – without sacrificing their lifestyle.

FAQ

1. How much should I contribute each year to maximize RESP, CESG and QESI for my child in Quebec?

For many families, $2,500 per year per child captures the full basic CESG and QESI for that year. If you started late, up to $5,000 per year can help you catch up on CESG.

2. Can I open an RESP and get CESG and QESI if my child is already in high school?

Yes, but time is limited. CESG is only paid until the year your child turns 17, and QESI also has age limits. A tailored catch-up plan can still secure significant grants.

3. What happens to CESG and QESI if my child does not go to post-secondary school?

You can withdraw your contributions tax-free, and in some circumstances transfer accumulated income to your RRSP, but unused CESG and QESI generally must be repaid to the governments.

4. Is RESP, CESG and QESI better than saving in a TFSA for my child’s education?

For education-specific savings, RESP with CESG and QESI usually provides more value because of the “free money” from grants.

5. How can a financial planner in Quebec help me maximize RESP, CESG and QESI for my family?

A planner who understands Quebec taxes, grants, and investments can design a year-by-year strategy that fits your budget, coordinates RESP with RRSP and FHSA, optimizes grant catch-up, and structures withdrawals to minimize tax when your child starts their studies.

Ready to align your RESP, CESG and QESI strategy with your overall Quebec tax and financial plan?

Contact me, Boris Kolodner, Financial Planner and Licensed Financial Security Advisor, for a personalized, year-by-year roadmap tailored to your income, family size and goals.

Free Consultation: +1-514-834-5558 • contact@bkfinancialservices.ca • https://bkfinancialservices.ca

Book your free consultation today – available in English, French, Russian and Hebrew – and see how much more support your children could receive for CEGEP, university or trade school.

Disclaimer: Information current as of January 2026; subject to program updates.