Moving to Quebec offers opportunities and responsibilities. Newcomers must quickly establish a financial foundation within the province’s unique structure. Quebec has its own health system, tax agency, and benefit programs. Banks offer specific newcomer packages, and many government services require key registrations.

A strong financial start simplifies the transition, protects against unexpected costs, and ensures access to essential benefits. This guide explains crucial steps for newcomers, their importance, and how provincial and federal systems interact.

Establishing Your Financial Identity in Quebec: Key Registrations

Newcomers must create a “financial identity” within Canadian and Quebec systems before accessing accounts or benefits. These registrations unlock essential services like banking, taxes, health coverage, benefits, and employment.

Key elements include:

- Social Insurance Number (SIN)

Required for employment, taxes, benefits and opening most financial accounts. - CRA (federal) online account

Used for federal tax filings, refunds and benefits such as the Canada Child Benefit and GST/HST credit. - Revenu Québec (provincial) account

Needed for provincial tax filings and credits like the Solidarity Tax Credit and Quebec Family Allowance. - RAMQ registration

Grants access to the provincial health plan. - Quebec-issued ID

A driver’s licence or provincial photo ID simplifies banking, telecom contracts and government applications. - Canadian bank account

Required for payroll deposits, federal and provincial benefit payments, bill payments and credit-building.

Without these registrations, newcomers often miss benefits, pay more for services, and lack financial security during their first year.

Understanding RAMQ: Health Coverage and Waiting Periods

Quebec’s health coverage (RAMQ) is crucial but not automatic. Many newcomers face a waiting period of up to three months before RAMQ coverage begins.

To secure health protection:

- Submit your RAMQ application soon after arrival.

- Provide proof of status, proof of residence and ID.

- Purchase temporary private insurance during the waiting period.

Even minor medical treatment without insurance can become a major expense. Interim coverage is a practical necessity.

Banking in Quebec: Accounts, Building Credit, and Access

Opening a local bank account is a practical first step. Quebec banks typically charge monthly fees, limit free transactions, and bundle features. Most offer specialized newcomer packages.

Examples of newcomer programs:

| Bank | Features |

| National Bank of Canada | Up to three years with no monthly fees, credit cards available without Canadian history. |

| TD Bank New to Canada Program | Free transactions during the first period, advisors who work specifically with newcomers. |

| Desjardins Newcomer Offer | Fee-free months, multilingual support, access to credit solutions. |

A bank account alone is insufficient. Newcomers should build Canadian credit early, as landlords, phone companies, and lenders all perform credit checks.

Effective ways to begin credit history:

- Secured credit card

- Newcomer credit card without prior history

- Small recurring payments paid on time each month

A strong credit foundation in the first year opens doors for future leases and mortgages.

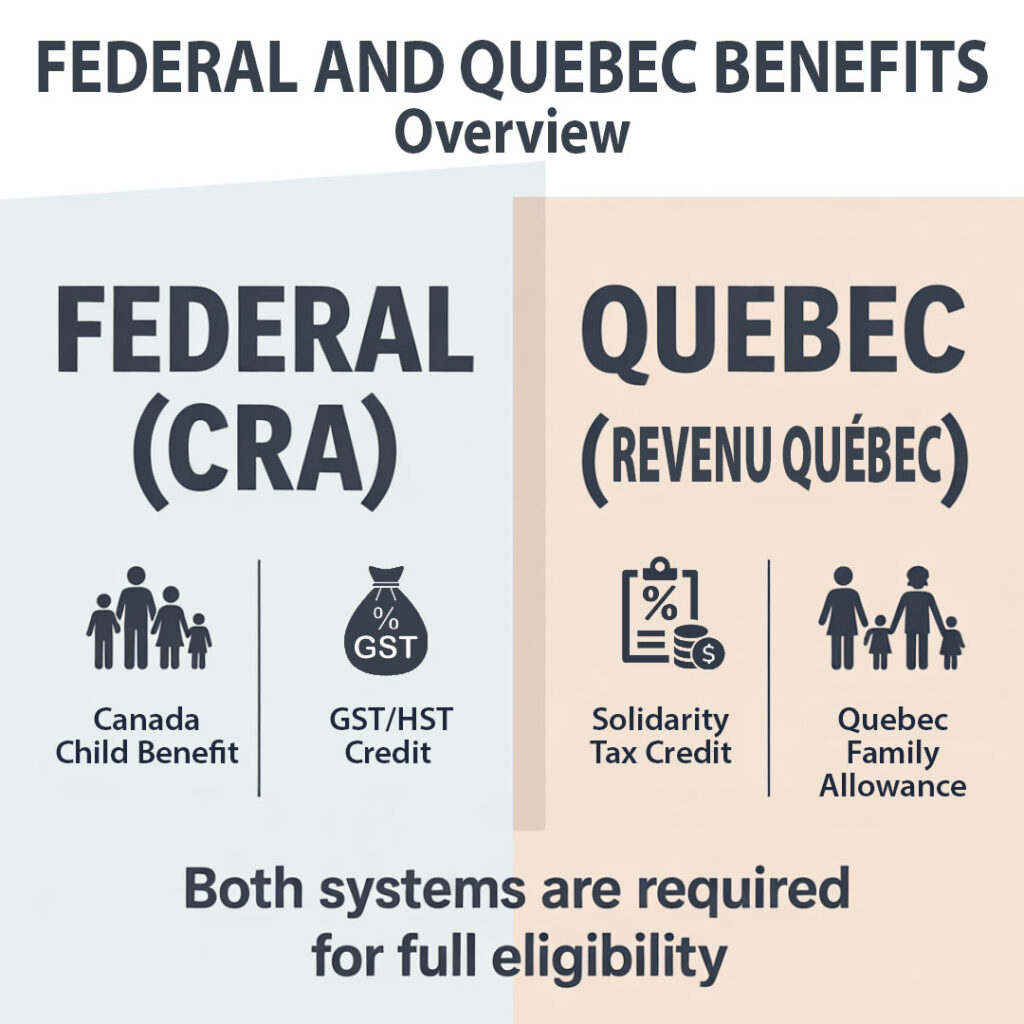

Accessing Federal & Provincial Benefits for Newcomers

Canada offers various income-based and residency-based benefits that significantly reduce living costs. To receive them, newcomers need a SIN, a CRA account, and a filed tax return.

Federal programs include:

- Canada Child Benefit

- GST/HST credit

- Federal refundable credits and deductions

Quebec, unlike most provinces, administers its own benefit system. Filing federal taxes alone is not enough for provincial payments.

Provincial programs include:

- Quebec Family Allowance

- Solidarity Tax Credit

- Quebec work premium

- Prescription drug coverage through RAMQ

Many newcomers miss these benefits by not registering with both CRA and Revenu Québec or not filing taxes during their first partial year.

Use the CRA Child and family benefits calculator to estimate your payments.

Quebec’s Dual Tax System: What Newcomers Need to Know

Quebec is the only province with a fully separate tax agency. Residents must file two returns annually:

- With the CRA (federal)

- With Revenu Québec (provincial)

Both filings are essential. They activate benefits, confirm residency, and ensure access to credits.

Common deductions and credits for newcomers:

- Moving expenses for work or school

- Childcare expenses, which substantially reduce tax liability

- Medical expenses not covered by RAMQ

- Professional association dues

- Some transit-related credits when applicable

Even with a late-year arrival or low income, filing taxes ensures benefit receipt during the following year.

Essential & Optional Insurance Programs for Newcomers

Some protections are built into Quebec’s system:

- QPP (Quebec Pension Plan)

- QPIP (Quebec Parental Insurance Plan)

- CNESST (workplace injury coverage)

- RAMQ prescription drug plan

Newcomers often underestimate the importance of additional protection.

Useful optional insurance solutions:

- Tenant insurance

- Life insurance for families

- Disability insurance to protect income

- Critical illness insurance

- Supplemental private health or dental plans

These protections ensure stability during unexpected events, especially while adapting to a new country.

Setting Up Telecom & Internet: Required Documentation

Most telecom providers require:

- Proof of address

- ID

- Credit check

Without Canadian credit history, newcomers may need prepaid plans or deposits. Internet availability depends on postal code; compare carriers by speed, installation fees, and post-promotion pricing.

Long-Term Savings in Canada: TFSA and RRSP Explained

Canada provides two tax-advantaged investment accounts newcomers should consider early.

- TFSA

- Tax-free investment growth

- Flexible withdrawals

Ideal for building an emergency fund and long-term savings

Note: Your contribution limit starts accumulating only in the year you become a tax resident. You do not get room for previous years.

- RRSP

- Contributions reduce taxable income

- Primarily for retirement

- Can be used for buying a first home under the Home Buyers’ Plan

Creating these accounts early helps build long-term financial security, even with small monthly contributions.

Common Financial Mistakes Newcomers to Quebec Should Avoid

- Delaying RAMQ registration or skipping interim health insurance

- Filing only a federal tax return and missing provincial benefits

- Using foreign bank cards with high conversion fees

- Ignoring credit building during the first months

- Accepting the first bank package without comparing terms

- Not updating addresses with CRA and Revenu Québec

- Missing child and family benefits due to incomplete registration

- Avoiding tenant insurance, which leaves belongings unprotected

Awareness of these issues prevents financial setbacks.

Your Practical Financial Checklist for the First Year

First two weeks:

- Apply for SIN

- Register for RAMQ

- Open a bank account

- Start a secured or newcomer credit card

- Create accounts with CRA and Revenu Québec

- Buy interim medical insurance

First month:

- Set up a mobile plan

- Review tenant insurance

- Apply for CCB and Quebec Family Allowance

- Open a TFSA

Within three months:

- File taxes if required

- Build an emergency fund

- Review optional insurance options

- Evaluate employer benefits

FAQ

What are the first financial steps I should take after arriving in Quebec?

In your first two weeks, focus on applying for your SIN, registering with RAMQ, opening a bank account, starting a secured or newcomer credit card, creating CRA and Revenu Québec accounts, and buying interim medical insurance if you have a RAMQ waiting period.

Do I really need to file two tax returns in Quebec?

Yes. Quebec residents must file a federal return with the CRA and a provincial return with Revenu Québec. Both are required to activate benefits and access important credits.

How can I start building credit in Canada without any history?

Open a secured or newcomer credit card, use it for small recurring payments like a phone bill, and pay the full balance on time every month. This helps establish a positive credit record in your first year.

Why is it important to register with both CRA and Revenu Québec?

Federal and provincial benefits are administered separately. Programs like the Canada Child Benefit and GST/HST credit are federal, while the Quebec Family Allowance and Solidarity Tax Credit come from Revenu Québec. You need accounts with both agencies and filed tax returns to receive the full range of payments.

Should I get private insurance if RAMQ has a waiting period?

Yes. A three‑month gap without coverage can make even simple medical care very expensive. Temporary private health insurance protects you during the RAMQ waiting period.

When should I open a TFSA or RRSP as a newcomer?

As soon as you have a stable income and can set aside small monthly amounts. A TFSA is usually best for emergency funds and short‑ to medium‑term goals, while an RRSP is more focused on long‑term retirement savings and potential home purchase under the Home Buyers’ Plan.

Secure Your Quebec Start in 2026?

If you are settling in Quebec and want a clear, personalized plan for your first financial year – covering accounts, benefits, taxes, insurance and credit – book a consultation today.

We will review your status, income, family situation and goals, then design a practical checklist tailored to your timeline in Quebec. The first consultation is free and can be done in English, French, Russian or Hebrew.

Call (514) 834-5558 or email contact@bkfinancialservices.ca to schedule your session and secure a stronger financial start in Quebec.