Each February in Quebec, employees often rush to make last-minute RRSP contributions, aiming to reduce their income tax. A few weeks later, an RRSP tax refund arrives, but it frequently gets spent on impulse purchases.

Used strategically, this refund can accelerate retirement planning, reduce high-interest debt, or speed up homeownership. A single smart decision each tax season can compound into tens of thousands of dollars over time.

This guide presents 3 smart, practical strategies for using your RRSP tax refund from February contributions. These strategies are tailored to Quebec taxes, RRSP rules, and current 2026 realities.

Understanding Your RRSP Tax Refund in Quebec

In Quebec, RRSP contributions create a tax deduction, leading to a refund upon filing provincial and federal returns. A higher marginal tax rate results in a larger RRSP tax refund for each dollar contributed.

Many middle-income Quebec professionals face a combined marginal tax rate of 37-42% in 2026. Consequently, a $5,000 February RRSP contribution could generate a $1,850-$2,100 refund. The critical decision is how to use this money for maximum long-term benefit.

Check your RRSP deduction limit via CRA “My Account”.

Strategy 1: Reinvest Your RRSP Refund for Retirement Growth

The first strategy is to view your RRSP tax refund as an additional contribution, not "found money." You can reinvest it into your RRSP or diversify tax shelters by investing it in a TFSA.

Reinvesting a $2,000 RRSP tax refund annually from age 35 to 60, at a 5% return, could accumulate over $145,000. Many Quebec families use this "auto-boost" method to close their retirement savings gap without significantly impacting monthly cash flow.

Strategy 2: Prioritize High-Interest Debt Repayment with Your Refund

For Quebec residents with credit card balances at 19-24% interest, using the RRSP tax refund to reduce this debt can outweigh additional investing. You retain the tax deduction from the February RRSP contribution, then convert the refund into guaranteed interest savings by clearing high-rate balances.

For instance, a client with $8,000 in credit card debt at 20% used a $2,400 RRSP tax refund for a lump-sum payment. This action saved nearly $500 in interest over 12 months, allowing us to redirect some of those savings into systematic RRSP and TFSA contributions.

OPTIONAL COMPARISON TABLE (adapted):

| Use of RRSP Tax Refund | Main Benefit | Best For |

| Reinvest in RRSP or TFSA | Higher long-term retirement savings | Stable income, low consumer debt |

| Pay down high-interest debt | Guaranteed interest savings | Credit card / personal loan balances |

| Build FHSA or home-buying fund | Faster path to first home in Quebec | First-time buyers and young professionals |

Optimizing Your RRSP Refund for Retirement Planning

Your RRSP tax refund offers powerful flexibility in retirement planning. Having already received the tax benefit, you can decide whether to use the refund for additional growth or to strengthen weak financial areas.

Retirement projections often compare spending versus reinvesting the refund. Over 20-25 years, the difference typically reaches five-figure amounts, even for moderate-income households. Strategic use of refunds can thus reduce the need for large contributions later in life.

Diversify Savings: RRSP Refund to TFSA Strategy

Quebec retirees frequently face significant taxes on RRSP/RRIF withdrawals, especially when combined with QPP, OAS, and pension income. Annually directing your RRSP tax refund into a TFSA builds a tax-free pool, which can be accessed later without impacting taxable income.

A balanced plan involves regular RRSP contributions via payroll, claiming the deduction on Quebec and federal returns, then automatically transferring the refund into your TFSA. This "RRSP-to-TFSA pipeline" particularly benefits younger professionals expecting future income increases.

FHSA and Home-Buying Goals with Your RRSP Refund

The FHSA (First Home Savings Account) changes how Quebec renters approach their RRSP tax refund. For first-time homebuyers, your February RRSP contribution and its refund can align with both the FHSA and the Home Buyers’ Plan.

A smart strategy is to fund your FHSA for a future down payment with your RRSP tax refund. You retain the RRSP tax deduction, receive your refund, and then contribute it to an FHSA, which also generates a tax deduction. This creates a double tax advantage for your home-buying fund.

Coordinating Your RRSP Refund with FHSA and HBP

A common Quebec strategy in 2026 for young professionals is:

- Contribute to RRSP in February to reduce current taxes.

- Use the tax refund to contribute to FHSA and/or pay down high-interest debt.

- Later, use both RRSP (via the Home Buyers’ Plan) and FHSA funds for a down payment.

Optimal amounts and rules depend on individual income, existing savings, and housing budget. Personalized simulations can demonstrate how coordinating RRSP, FHSA, and Quebec mortgage rules can shorten the path to home ownership by years.

Managing Net Income and Cash Flow with Your Refund

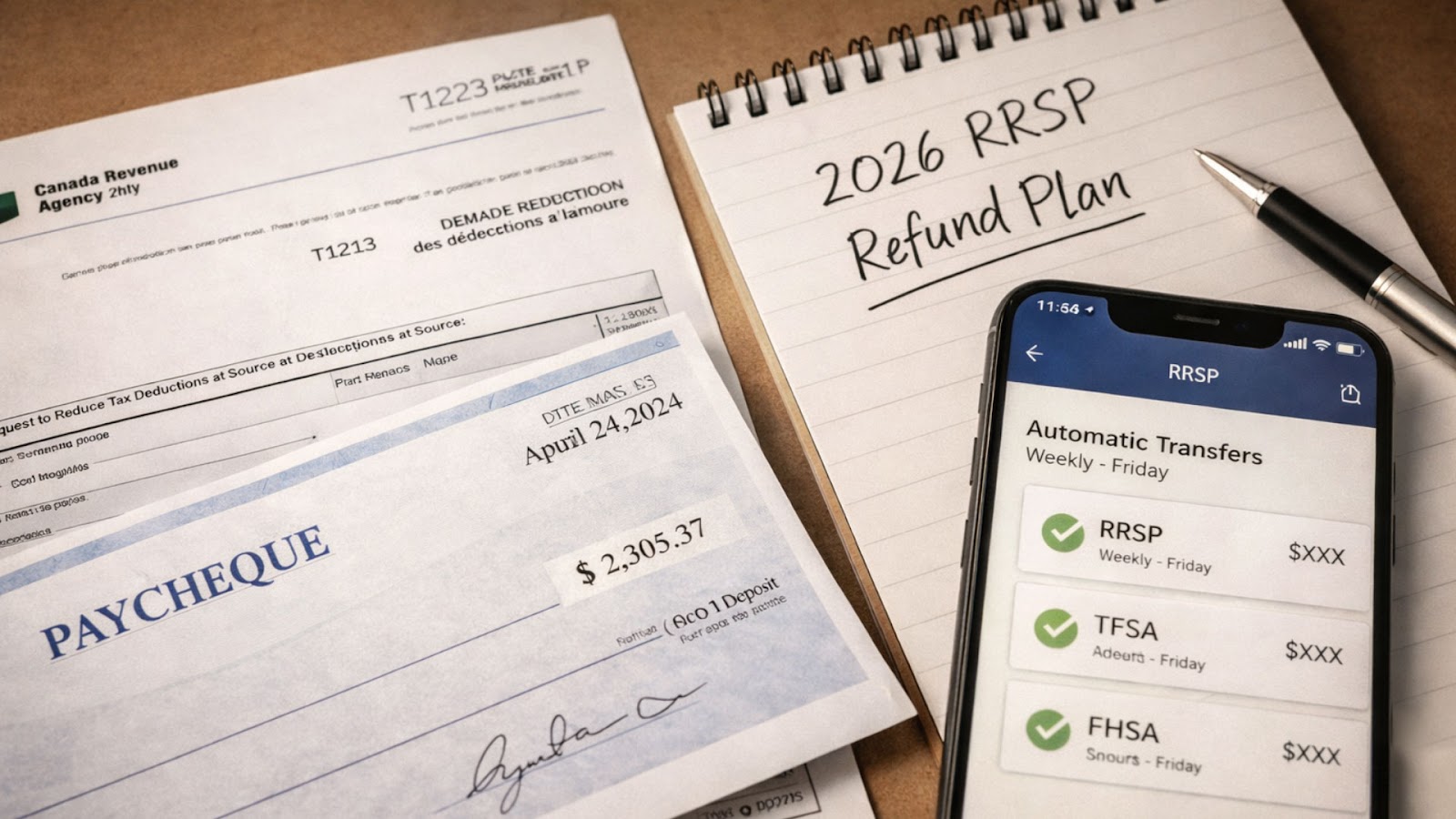

The RRSP tax refund directly relates to your net income and paycheque structure. While many Quebec employees consider RRSPs only in February, proper planning can smooth annual cash flow and reduce tax-filing "shock."

An advanced tactic involves adjusting payroll deductions or using form T1213 (and Quebec equivalent TP-1015.3). This reflects part of the RRSP tax benefit directly on each paycheque, rather than as a lump-sum refund. You can then automate monthly contributions to RRSP, TFSA, or FHSA from this higher net income.

Need help with T1213 or TP‑1015.3? Contact me.

Developing a Yearly Plan for Your RRSP Refund

Here’s a simple framework I use with clients:

- Step 1: Use this year’s RRSP tax refund to clean up any high-interest balances.

- Step 2: Next year, convert at least part of that freed-up monthly payment into automatic savings.

- Step 3: Review annually how February RRSP contributions and expected refunds fit into your broader Quebec tax and retirement picture.

Linking your refund to your budget prevents the cycle of making a large annual contribution, only to see its benefit diminish through unplanned spending.

Real Cases: Using RRSP Tax Refunds Strategically in Quebec

Case 1: Young professional, Montreal, planning first condo

A 32-year-old engineer contributed $7,000 to her RRSP in February, resulting in a $2,800 tax refund. Her initial plan was to use the refund for a vacation.

We restructured her plan as follows:

- Used $1,500 of the refund to open and fund an FHSA.

- Applied $1,300 toward a credit card balance at 19.9%.

Result after 12 months: lower interest costs, a growing FHSA with additional monthly contributions, and a clearer 4-year path to a condo purchase using both FHSA and the Home Buyers’ Plan.

Case 2: Self-employed consultant, Laval, irregular income

A 45-year-old self-employed professional with volatile income often used his RRSP tax refund for spring expenses. One year, his February RRSP contribution generated a $3,600 refund.

We implemented a new strategy:

- Used $2,000 of the refund as an emergency fund top-up in a high-interest savings account.

- Reinvested $1,600 into his RRSP as a lump-sum, coordinated with a change in instalment payments.

Within two years, he had a more stable cash buffer, reduced dependence on credit lines, and his retirement projections improved by roughly $40,000 at age 65 due to the additional reinvested refunds.

FAQ

1. How should I use my RRSP tax refund from February contributions in Quebec?

Prioritize three areas: pay down high-interest debt, reinvest in RRSP/TFSA/FHSA, or build an emergency fund. The best mix depends on your marginal tax rate, debt levels, and retirement or home-buying timeline.

2. Is it better to spend or reinvest my RRSP tax refund for retirement planning?

Reinvesting usually wins in the long run, especially if you have little or no high-interest debt. Redirecting the refund into RRSP or TFSA each year can add tens of thousands of dollars to your retirement savings thanks to compound growth.

3. Can I use my RRSP tax refund to help buy a home in Quebec?

Yes. You can use the refund to contribute to a FHSA or increase savings earmarked for a down payment. Later, you may also tap your RRSP under the Home Buyers’ Plan, combining these tools for a stronger down payment.

4. How does my marginal tax rate affect the RRSP tax refund from February contributions?

The higher your marginal tax rate, the larger your refund per dollar contributed. That’s why higher-income Quebec professionals often see the biggest absolute benefit and should be especially intentional about how they deploy each year’s refund.

5. Should I adjust my payroll so I don’t get a big RRSP tax refund each year?

In some cases, yes. Reducing source deductions to reflect expected RRSP contributions can increase your net pay throughout the year, which you can then automate into investments. But many people prefer the psychological boost of a lump-sum refund; a planner can help decide which fits your habits best.

Ready to Optimize Your RRSP Tax Refund Strategy in Quebec?

Free Consultation:

Phone: +1-514-834-5558

Email: contact@bkfinancialservices.ca

Site: https://bkfinancialservices.ca

Book Free Consultation Today – Available in English, French, Hebrew.

Together, we can analyze your Quebec tax situation, your RRSP contributions, and your February refund to build a customized plan for debt reduction, retirement, or home buying.

The information in this article is current as of 2026 and may change with updates to tax laws.

Disclaimer: This article is provided for informational purposes only and does not constitute legal, tax, or professional financial advice. Mortgage rules, interest rates, and Quebec provincial regulations are subject to change. Before making any financial decisions, consult with a qualified professional to evaluate your specific situation.